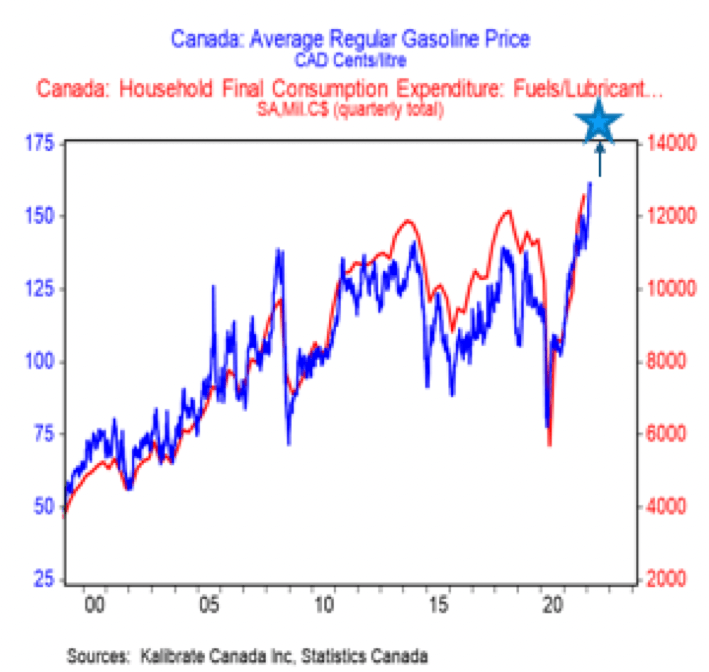

The global energy shock is driving costs higher everywhere, and Canadians can feel it at the pump. BMO Capital Markets took a stab at estimating the consumer impact from rising prices. Their research shows gas was ~$1.80/liter on Monday, up from $1.60/liter last week. That’s on top of the increase from last year, sending costs even higher for consumers. At current prices, households will pay an extra 1% of their disposable income.

Rising Gas Prices Can Cost Households An Extra $1B Per Month

There are a lot of variables to determine how hard rising oil prices will hit consumers. Ultimately the length of time is the biggest determining factor on consumer impact. Without a resolution in sight to the Ukraine conflict, that might be a while. Especially if further bans on oil imports hit the US, don’t expect the turmoil to end anytime soon.

BMO sees gas costing a lot more as long as prices are at the current level or higher. Households spent $12.6 billion on transportation fuels and lubricants in Q4 2021. With an average price of $1.45/liter in Q4, the bank estimates fuel use to be 2.9 billion liters per month.

“If current prices hold, this would imply an additional outlay on gasoline of just over $1 billion per month,” estimates BMO.

The price holding is a crucial point, as many observers see oil prices climbing further. Earlier today, Bank of America’s forecast put oil as high as $200/barrel. That’s significantly higher than the $119/barrel it’s currently trading at. Since transportation costs trickle into everything, it can cost consumers even more.

Rising Gas Prices Can Eliminate Another 1% of Disposable Income

Is an extra billion in gasoline costs a lot for the size of the population? When dealing with large numbers, they tend to lose all meaning, so a little context is important. To understand this scale, BMO contrasts the costs to disposable income. Their calculations show disposable income at $119 billion per month in Q4 2021.

“So, the extra gasoline costs will absorb about 1% of disposable income at current prices,” says the bank. Adding, “the good news is that the excess savings cushion was ~$300 billion.”

Canada’s economy has a lot of plans for the not-so-large savings pile that’s held largely by high income households. Those plans seem to revolve around those savings being eaten up by a higher cost of living, too.

Will be a lot more if other companies need to raise prices for goods and services. We can’t trust banks and government because they got us into this mess in the first place. Lack of regulation in the market and ultra low interest rates created a monster.

It’s not just lack of regulation and artificially low interest rates, but those factors certainly contributed. The commodification of housing is at the core of this bubble. Fomo is real. Residential investment is half of all investment in Canada now. 50% of Canada’s economic growth in recent years is housing-related.

As long as the Canadian gov’t treats real estate as a protected investment, the bubble will continue to grow. The Canadian gov’t keeps saying immigration is driving the bubble but since 25% of new homes are being bought by speculators, that seems unlikely. I’m sure you know people buying and flipping homes that don’t even exist yet. Canadian real estate is also a favorite place for international money launderers to ‘snow-wash’ their ill-gotten gains. One solution for the money laundering that is driving up prices in Toronto & Vancouver is fairly simple–as Transparency International has frequently noted–a public registry of beneficial ownership. That would be fairly simple to implement and would chase away a lot of dirty money. It seems that the gov’t is afraid to do this for fear of popping the property bubble. Meanwhile, middle class Canadians are spending an absurd amount of their incomes to keep themselves housed.

1% if we all ride mopeds.

We need a revolution in Canada. BOC and government ignoring increase in Rent. Rent has risen by 50% in many parts.

Did disposable income increase by 50%.

Agreed. Something definitely needs to change. The real issues are being ignored and fueled further by the current government and BOC. It’s time for some fresh leaders to step forward who understand the true issues Canadians face today.

Good point. ‘In the last two decades, home prices have gone up by 375 percent in Canada. These increases have been especially marked in in Toronto and Vancouver, where prices have swelled by 450 and 490 percent respectively. This rise far outstrips any other developed markets in the world. In recent years, an incredible gulf has opened between house prices and real income.’

https://www.jacobinmag.com/2022/01/canada-housing-market-real-estate

Just more pressure on Canada’s massive housing bubble. This 20+ year bull market is rapidly running out of steam.

Running out of steam? Here in KW the average detached was +133k in January and now another +75k in February … houses sell instantly and there is no inventory.

I wonder when we see the first defaults? I can not understand how people find money to service their debts.

$ + Laundy = Canada housing