Canada’s economy has been lucky enough to buck recession forecasts, but its luck may be running out. The country’s latest job report showed huge job gains in June. However, it’s the rising unemployment rate that caught the attention of BMO’s chief economist. In a note to investors, they warned the rising rate has a near-foolproof record of forecasting a recession.

Canada Is Adding Jobs, But More People Are Unemployed

As mentioned last week, Canada added a significant number of jobs last month. The 60,000 jobs added in June weren’t enough to stop the unemployment rate from climbing to 5.4% over the same period. Most of the market reaction focused on the gains, and how it reinforces the chances of a rate hike.

“While we won’t quibble with that conclusion, let’s also not forget that the jobless rate is steadily grinding higher,” said Douglas Porter, chief economist at BMO.

He notes the 5.4% unemployment rate is now up 0.5 points from the cycle low. It was hit twice in the past year, he reminds investors.

Canada’s Rising Unemployment Signals A Recession Is Approaching

Canadian unemployment is close to showing a recession, according to the Sahm Rule, warned the bank. Those following the US economy might have heard this term in the past few days. In short, it’s a US rule that predicts the start of a recession by looking at the 3-month moving average of the unemployment rate. If the moving average rises 0.5 points from the 12-month low, it’s begun.

Porter’s calculations show Canada’s moving average is at 5.2% in June, up 0.3 points from the 12-month low. “We’re not quite there yet in Canada, but we will be if June’s rate holds in the summer,” he said.

It’s Different This Time… Until It Isn’t

Analysts generally shrugged off rising unemployment due to the population boom. The rise in population outpaced job gains, which many feel is an unusual circumstance that’s not typical of rising unemployment. Afterall, people aren’t losing their jobs, so it’s totally different, right?

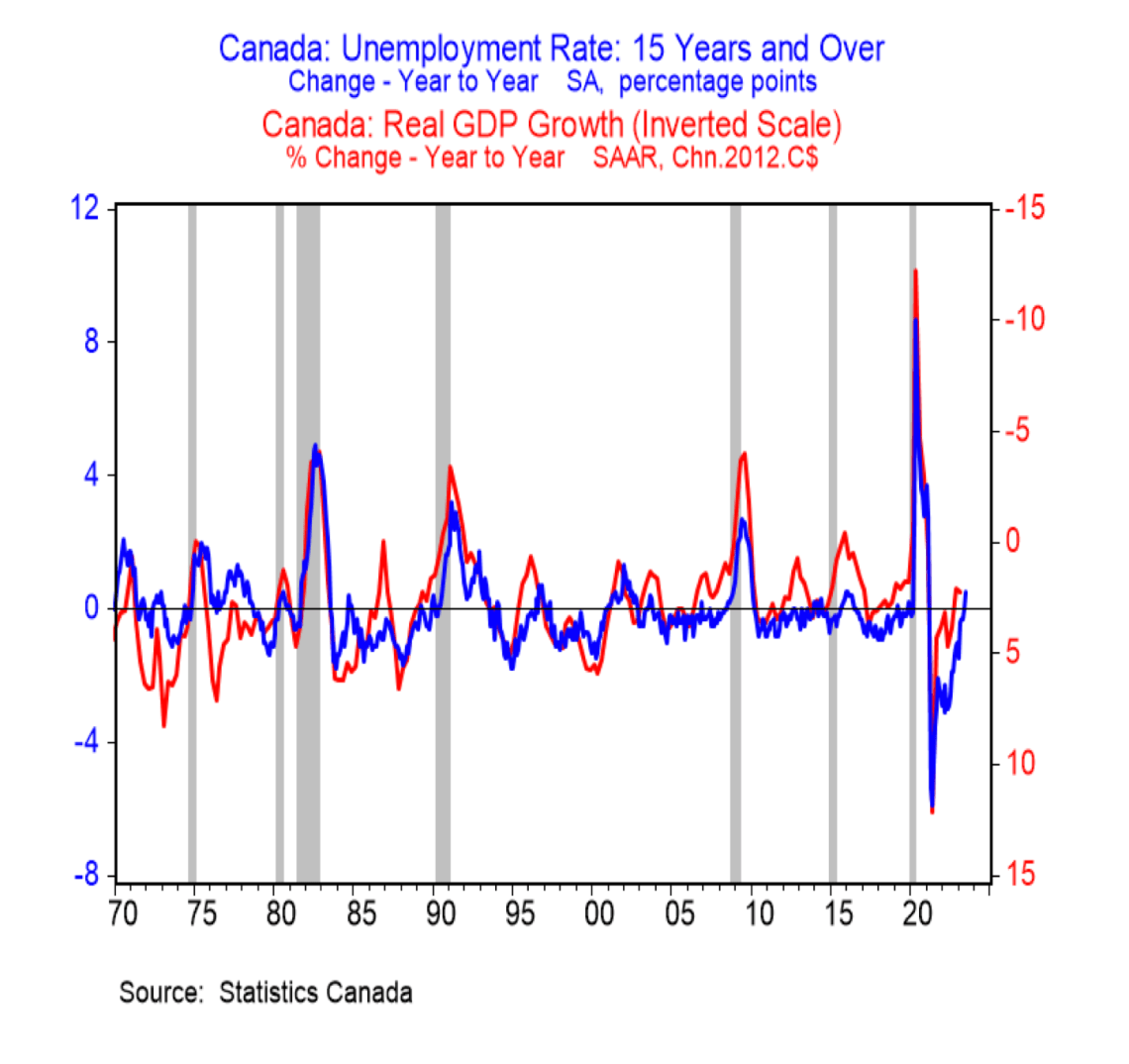

The issue is this isn’t an exception—Canada typically sees large population booms before recession. Porter points to the population booms in the 70s and 80s, which produce a “near foolproof” recession signal chart.

Source: BMO Capital Markets.

“There have been episodes where a move similar to the 0.5 ppt rise in the past year have not translated to a full-blown recession, but they were near-misses (e.g. 1995, 2001),” he said in relation to the above data.

Rising unemployment also happens to be the necessary ingredient for a housing correction. While 2020 proved to be a big exception due to the record stimulus, most experts agree that scale of unprecedented stimulus is unlikely for a typical recession expected at the end of a business cycle.

I just love how economists use the word “unemployment” – the state in which people able and willing to work can’t find work – but also love how they then take the sting out of it by converting it into a percentage.

EACH unemployed person is a breadwinner not able to feed his family anymore, not able to provide shelter, not able to pay for school/college for his kids.

EACH one.

If this is the best the so-called experts in a socialist economy could come up with, they all need to be stripped of their PhDs and fat-cat salaries, and asked to live for just a month on Employment Insurance. They’ll be tripping over themselves to rethink their economic models.

There is no such thing as an “acceptable level of unemployment”. Only for the chart geeks; for the actually unemployed, no level is acceptable.

This isn’t a typical recession at the end of a typical business cycle. This is the end of a long term debt cycle and a crack up boom. But which business cycle do you refer…. the 2020 lockdown economy (curtailed supply) massive stimulus (orchestrated demand) = econ 101 recipe for rapid inflation. So if this is part 1 of the business cycle you speak of the economy did not grow resulting in real “earned” income growth resulting in sustainable demand and prices fundamentally supported by the underlying economy. It merely was unsustainably inflated by design by policy. Act 2 to this “orchestrated business cycle” will see the recession the world was already heading to come Sept 2019. Except now it will be far worse…. because of a genga of crises, credit, liquidity, debt….. far worse because the central banks are pile driving the economy into the ground to get rid of the inflation they created/ along with the fiscal debt. To solve for this will be…. more stimulus!! and inflation will climb higher than before…. by design to reduce debt/GDP ratios by collecting more tax from the orchestrated higher prices. This is the policy. Its nothing new. 3 spikes to M2 in 1933-1946 and in the 70’s all followed by spikes in inflation. 2020-2022 was spike 1. Following the next round of stimulus will be spike 2 and stagflation. Now where in here is the business cycle? There are no free markets or real price discovery…. only the whims of central banks pushing prices up and down. Thats not business cycle. Its communism.

Toronto REITs still demand $2,500 a month for a 1 bedroom apartment though. It’s a bad situation because in 2008, rents were going down, but today, rents are creeping up higher and higher despite the job losses.

Well when more people will start losing their jobs, those who are paying high rent won’t be able to afford their rent anymore, which in turn can’t pay the investors who have several investment properties who still have mortgages with rising rates. The number of investors provided are skewed, I believe its much much higher. Then you know what happens..I don’t need to spell it out for you. And that folks is what you call Risk 😉