Canada’s central bank will be watching home prices carefully when setting interest rates. In a note to investors, BMO Capital Markets explained that falling new home prices reduced the consumer price index (CPI) readings. However, they’re starting to bottom and are likely to become an influence on higher inflation. The Bank of Canada (BoC) is expected to keep a close eye on home prices, as they turn into an inflationary risk.

Helter Shelter

Shelter is the largest cost Canadians face, and therefore has the biggest influence on the CPI. Shelter is the largest major component, representing 28.34% of the CPI basket. Rents (6.79% of the basket), and homeowner replacement costs (5.47%) are the largest subcomponents, and can drive big swings. We all know that soaring rents have been a big contributor to inflation, you might be less familiar with homeowner replacement costs.

Replacement costs are often used in the insurance industry. It’s the cost of replacing something at the current price. In the case of a house, it might have been built for a nickel in the 60s, but replacing it would reflect current building costs. To determine this, Stat Can refers to new home prices, which is where BMO sees rising inflationary concerns brewing. Put a pin in this, because there’s a quick point that needs to be clarified about inflation.

Canada Adopted A Model That Will Chronically Understate Inflation

Canada’s recent changes to its CPI methodology will chronically underreport inflation (further). The shift involves annual changes to the basket, making it much more volatile. There’s a reason they don’t adjust Census boundaries annually—short-term fluctuations happen, and adjusting them immediately can be problematic. Imagine cutting school funding if two families move out of a neighborhood, only to see two more come in a year later?

The price of most goods can fluctuate that rapidly too, with a big surge followed by a pullback. By adjusting the basket annually, contributions to inflation will be understated, and contributions to deflation will be overstated. It’s a problem Canada’s major banks have shared. It’s a problem our staff was invited to discuss with Stat Can. They see why the issue is a concern with Census, but not things like shelter.

The impact on shelter has been wild to say the least. While Canadians struggle with higher and higher shelter costs, both owners and renters—the basket weight shrank. In 2020, shelter represented 30% of the basket. Last year’s brief decline in home prices, which only a small share of people realized, resulted in trimming nearly two points from the basket. Keep that in mind while you read the rest.

Falling New Home Prices Are Helping To Reduce Inflation

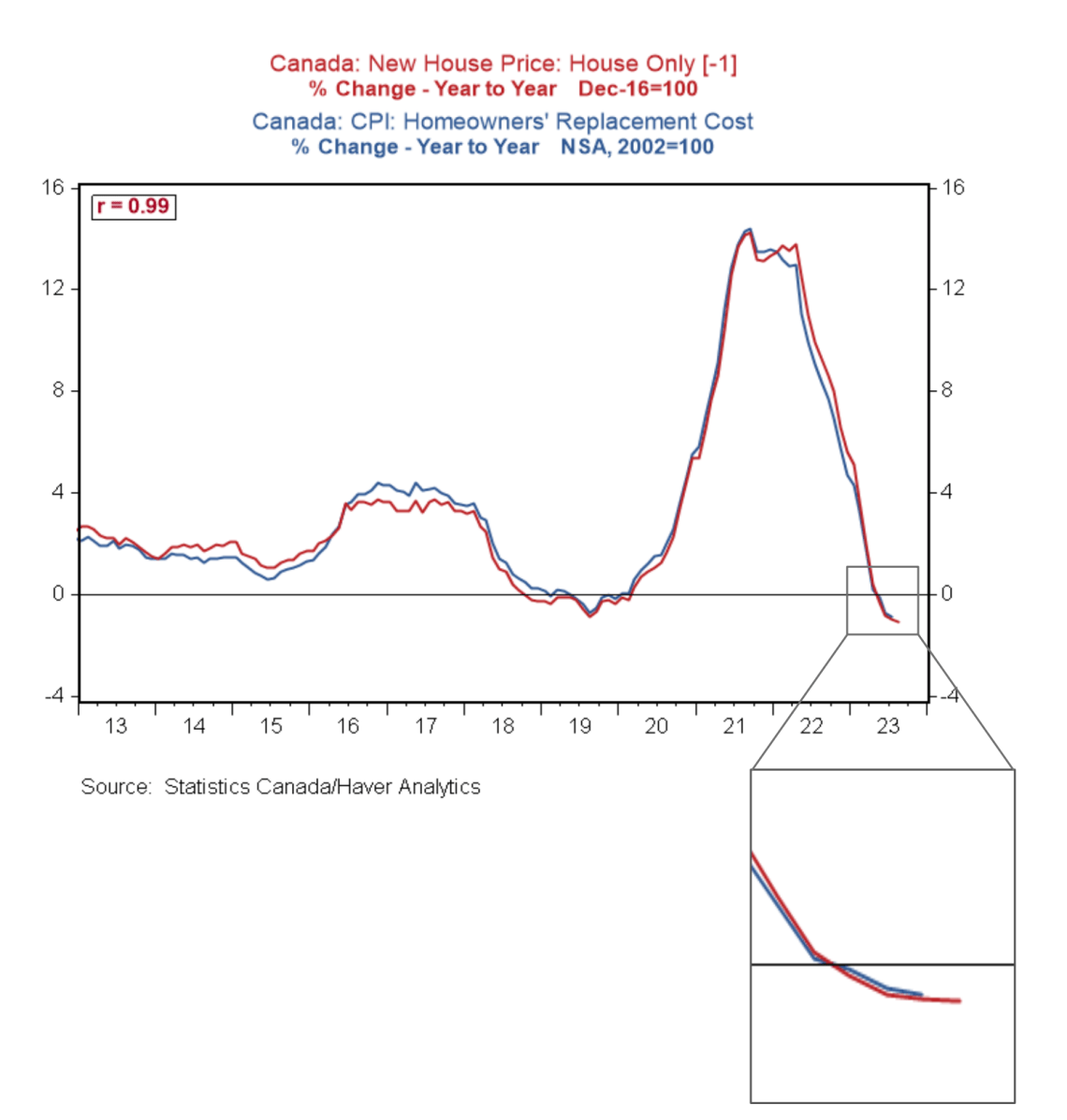

New home prices in Canada surged in the early 2020s, driving inflation higher via homeowner replacement costs. Helped by the overstated inflation issue, the pullback that followed after rate increases helped bring CPI lower. That momentum, helped by a base effect, is expected to continue contributing to lower inflation in the near-term.

“New home prices continued their disinflationary march in July, pointing to further cooling in this component of shelter costs for the August CPI report,” explains BMO economist Shelly Kaushik.

Adding, “Momentum slowed quickly as the Bank of Canada started raising rates in 2022, with base effects bringing annual growth into negative territory for the past four months.”

Source: BMO Capital Markets.

New Home Prices May Resume Their Climb, Pushing Inflation Higher

Looking at the above chart, you can see Kaushik’s concern. The year-over-year negative growth is beginning to bottom. Once it gets back above zero, it will resume its contribution to higher CPI, and reinforcing higher interest rates. It can even cause rates to climb further, depending on how much growth it experiences.

“While past monetary tightening will continue to weigh on the housing market in the coming months, the correction looks to have bottomed out. Positive monthly moves in the NHPI suggest it could start adding to inflation again,” says Kaushik.

Observers of interest rates should keep an eye on the cost of shelter in the coming months. “Looking ahead, the direction of shelter costs will be a major factor in broader CPI inflation, so the Bank will keep a close eye on house prices as it weighs its decisions for the rest of the year,” she warns.

Canada needs to get interest rates back to 0.5-1.0% range to support housing.

Oh look the BOC is watching their intentional destruction. Clown world

🤡 🤡🤡🤡🤡🤡🤡🤡🤡🤡

We can say thank you to the dictator clown Trudeau for destroying this beautiful country.

Watching housing ‘becoming’ an inflation risk? You mean they don’t consider housing affordability a problem yet? What’s the threshold we need to cross before the BoC says its a problem?

I’m not sure how watching (or even measuring) the CPI really matters when it comes to housing affordability. Isn’t the differential between dollars earned, and dollars needed, the fundamental that we really need to pay attention to?

The price of most goods can fluctuate that rapidly too, with a big surge followed by a pullback. When, pray tell have you seen prices pull back, Walmart rollbacks ? We now know why your eyes are brown.

The world is awash in debt. In all, personal, corporate, and government debt is more than 300 trillion. The spike in debt is historically unprecedented. Capitalism is on a knife edge on this. Actually, the edge was long ago passed. The working class mass is now cut deep and bleeding. The capitalist financiers–the ruling class–insist on being repaid. How long until the pitchforks come out. Already polls show that 30% of Canadian youth, 18-35, agree that communism is preferable capitalism. That is more than a million Canadian young people! Objective conditions are going to get worse. That’s what is driving these numbers.

Money laundering was easy through Canada’s housing market ,driving up prices, outbidding buyers ot backing off to cause prices to rise. The BOC changing goal posts at will ? Strip away mortgage interest costs and CPI would be at about 2.5% A never ending spiral has been created.. Tiff needs to be fired.

What does Tiff have to do with foreigners doing their dirty laundry in Canada and driving RE prices up? Stop blaming Tiff for what the government has turned a blind eye to and facilitated. Tiff is also NOT responsible for immigration and other scams that prop up RE prices.

If you have not noticed though, there are several countries of the once great West with the same fate as Canada – RE prices gone through the roof, interest rates down too long and now going up, citizens disregarded in favor of immigrants… there is a “pattern” to these events, not just a coincidence IMHO. All these countries are linked to the WEF and 2030 vision of a “New World”. All of these countries a few years back made daft claims that they “embrace” newcomers and the doors are open. None were ready for the influx (Netherlands, Germany, Oz, US, Canada, and several other EU countries, just to name a few). During the plandemick, it was as-if all of these countries were reading the same manual on how to screw their citizens over to implement the great plan.

NOTHING in life on the grander scale of things, is a coincidence, everything is well-orchestrated and thoroughly planned by our higher powers.

I fail to understand how the bank of Canada calculates the inflation as nothing seems to be getting cheaper for Canadians. Gas, groceries, cars.. you name it and it has gone up in price. After the crazy rate increases the mortgage payments have gone way up for people with variable rate mortgages and will go up for the folks who will renew their fixed rate mortgages. The direct result of that is a huge increase in rents for all the people who are renting. A two bedroom basement suite is $2000 a month in and around Vancouver while the wages remain the same. This is squeezing everyone. The government should bring a better plan otherwise this country is not going to remain great anymore.

So the liberal/ndp government prints oodles of cash that drives up inflation, so the BOC raises interest rates to slow inflation causing mortgages to rise raising housing costs. Then the BOC says it may need to raise rates to stop the inflation if of housing costs.

I hope people remember this when the next election takes place. This is all government driven to bankrupt the middle class and poor.

The old school belief that if it was built for .05 in the 60s it has to be replaced at current value is ridiculous.

No 80 year old home is new, most are not even in new condition. There should not be a new home price on an 80 year old one.

Few people update or even maintain their homes. You can drive any neighborhood in the GTA and find shingles missing, windows rotten, landscaping heaving, driveways cracked and front walks unsafe… yet there all a million bucks?

Oh wait… The green belt… Thanks Mr Ford. Now I will have affordable housing… oh they start at a million too up in Pickering. (Seaton) (Treasure Hill)

That’s not affordable at all Doug!!

Sigh…..