The number of people that shouldn’t be purchasing Toronto real estate, but are buying anyway, is skyrocketing. At least that’s the consensus from the latest high-ratio mortgage data we scored from the Bank of Canada (BoC). According to these statistics, more people are entering into high-ratio mortgages, and they’re doing it with a high loan to income ratio as well. The combination makes these buyers perfect candidates for defaulting on their mortgages.

High Ratio Mortgages

High ratio mortgages are ones with minimal equity in the home (i.e. the down payment the buyer had was really small). The industry defines a high ratio mortgage as any mortgage with a loan-to-value ratio of more than 80%, which basically means anyone with less than 20% down. These types of loans have little risk for the lender, since the borrower also has to pay the cost of securitization (a.k.a. they have to buy default insurance). Keep in mind, the default insurance the borrower is required to purchase actually covers the bank in the event of a default, not the borrower. The borrower still assumes all risk.

Experts say you should have a loan-to-income ratio of less than 300%. In plain english, this means your mortgage should be 3x your gross income max (less if you have significant debt). If you make $100,000/year, and want a $400,000 condo – you should have $100,000 as a downpayment (25%). Any less, and your chances of carrying that loan become increasingly more difficult. If you’re high leverage, and have a mortgage over 300% of your annual income, you’re at a large risk of default. If that ratio exceeds 450% and you’re also a high-ratio borrower on top of it, the odds are stacked against you.

Toronto Seeing More High Leverage Loans With A High Loan-to-Income Ratio

Recently, Toronto has seen a massive increase in people who have high leverage loans, and also have high loan-to-income ratios. According to the BoC, “almost half of the high-ratio mortgages originated in Toronto in the third quarter of 2016 had LTI ratios exceeding 450%.” That’s right, 49% of high ratio mortgages also had a dangerous loan-to-income ratio. The same quarter in 2015 saw 41%, and that quarter in 2014 was just 32%. So the loan quality has been rapidly deteriorating over the past couple of years.

Spreading Beyond Toronto

The problem isn’t just isolated in Toronto, it’s spread to surrounding cities. Oshawa and Hamilton both saw high-ratio mortgages with high loan-to-income ratios more than double in the past 3 years. BoC analysts saw the ratio increase from 10% to roughly 25% over that time. Now I know Oshawa is the Manhattan of Eastern Ontario, but I’m not sure a high-leverage mortgage that’s out of your budget is a smart idea.

The quality of loans deteriorating rapidly over the past two years should be a sign of how healthy this market is… or isn’t. Toronto real estate prices have had a thirty year run, without much resistance. Suddenly over the past two years, people that shouldn’t be buying houses are scrambling to get into the market. These buyers are taking out loans they’re likely to default on. Since they’re insured, banks have little to no risk, but as I mentioned above, the risk still falls on the buyer. Unfortunately, this doesn’t just impact the people who are taking out these risky mortgages, it’s contributing to rising prices for responsible homeowners as well.

Like this post? Like us on Facebook for the next one in your feed.

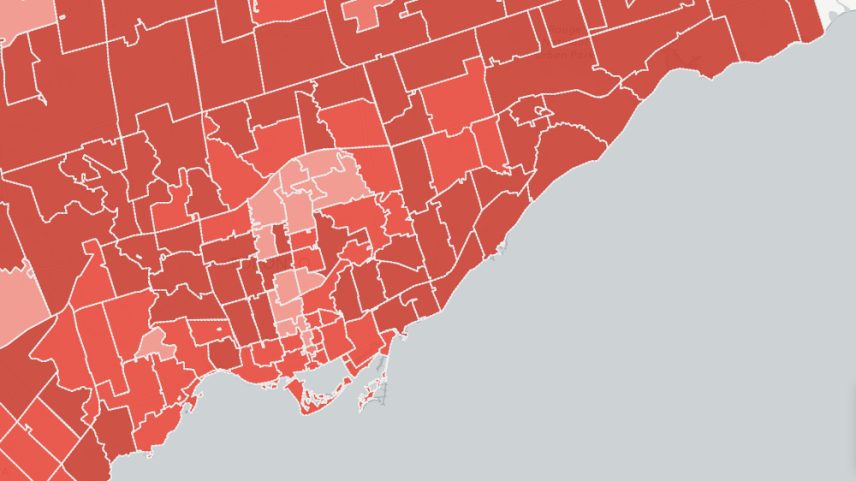

Map Sources: Department of Finance Canada; Postal CodeOM Conversion File (PCCF), 2016; Statistics Canada Catalogue no. 92-154-X; Forward Sortation Area Boundary File, 2011 Census; Statistics Canada Catalogue no. 92-179-X; Google; and Bank of Canada calculations, Better Dwelling.

Unbelievable that people can be so dumb.

Thanks for the map! It’ll serve as a shopping guide when these tools default on their homes.

You’re right. 100s of people are about to lose their homes, and we’re high-fiving at the office because of how many assets we’re going to be able to scalp. It’s horrible if you think about too long, So just take a money bath and pretend people don’t exist.

No wonder banks don’t want to share the risk, they’re basically printing money with no liability. Tax payers will pick up the slack.

They are not printing money. Canadian banks are well capitalized. They are pimped by federal government to launder hot money.

http://projects.thestar.com/panama-papers/canada-is-the-worlds-newest-tax-haven/

All they need is you to buy at inflated values. They give you mortgages to make you busy and weed to stone you stupid. Apparently beer doesn’t work anymore.

Great report. I wonder whether the data represents all outstanding mortgages or whether the data represents new mortgages (e.g., originated in the last year or over some other period of time)?

I suspect this data represents mortgages from regulated lenders since I suspect there is no way to track mortgages for unregulated lenders? I wonder what is lurking in the shadows.

Pretty sure we don’t have any information on alternative lenders, since they don’t even enter the government securitization process. I could be wrong, but I believe they’re classified as “shadow banking,” which the government doesn’t collect information on.

Me thinks you are right…just t/ tip of t/ ICEBERG…time to SELL…if you can.

when was the last time banks lent money at Multiple of your Income (which ignores Interest Rates) vs Payments (that include interest rates) right, Never.

Not only the LTI ratios are high, some people even fake the income with the help of brokers, this makes really LTI ratios even higher. The potential risk of housing crash should come sooner, rather than later.

I generally agree with the opinions on this site regarding the market, and I would say it’s a confusing mess out there, so the conclusion of this article may be accurate, but I have an issue with the reasoning.

The government and mortgage insurers set guidelines that they are comfortable with and do so with a great deal of data. Using current insured mortgage guidelines, a theoretical household income of $100,000 could qualify to purchase a $500,000 house with 5% down. That is 500% of household income. A 5 year fixed mortgage at an mediocre mortgage rate (at this point in time) would result in a payment of less than $2300/m, and even if only getting the benchmark rate of 4.64%, the payment would be around $2770/m. These insurer current guidelines are also FAR more conservative than they have been at any point in the past 10 years, and there have been no crashes so far.

I do think there is a ceiling that people are approaching quickly with the increase in prices, but I think there are other factors that would be more pressing in causing a real estate crash than this one.

Your hypothetical doesn’t exist in reality. What can you realistically purchase for $500,000 in the GTA other than a condo. Even out in the sticks in Milton townhouses are going for $700,000 and even $800,000 and those are starter homes that people making $80,000 to $100,000 are buying. Even with 20% down their mortgages are $500,000 to $600,000. What is happening is banks are giving them most of the loan but companies like Home Capital are topping them up another $100,000 to $150,000 to close the deal on these bidding wars. Those Alt lenders aren’t even regulated and that’s the biggest problem. All we have here is a house of cards.

“Home Capital” does not even do second mortgages. They also require at minimum 20% downpayment. Further, the banks would not allow a second mortgage behind them to increase the price, especially without debt servicing the second mortgage into the deal. You are not making informed comments.

I deal with a lot of reality, and the numbers I put in my comment reflect current government policies. I am not disagreeing in that I think things are crazy with the frenzy of buyers and multiple offers, but my point was that the government policies even allow for 5:1 home to income ratio, and that it used to be even far higher. There are other factors at play.

OK, what, ‘other factors are more pressing’?

80% of people putting less than 20% or 10% down, if over or under 500k is insane. In 2008, it was 20% were putting less down than recommended. When I bought my first house 9 years ago, I didn’t even know you could put less than 20% down, I had never heard of anyone doing it. 9 years later, the subprime mortgage market in Canada sounding like the US, its only a matter of time, be it long or short before this whole thing goes to hell. Canada has highest household debt-to-GDP in G7, one of the highest in the world, how long can it last.

But I want to point out that people relay on rental income to support part of the mortgage, and assume 50% of the mortgage is support by the rental income, then the debt ratio can easily go to 1000%

[…] of Finance (MoF), high ratio mortgage borrowers are extending themselves to the limit. While we covered how concerning this trend has become in Toronto, it’s not just isolated to that city. It’s a trend that’s growing across all Canadian urban […]

Me thinks a lot of homeowners are sing their home as an easy ATM, in order to keep that ‘lifestyle’ goin’. A LOT of people are going to loose their homes…and ALL t/ money they lost in t/ gamble…of ever-increasing home prices….when there’s no/low paying jobs.? Get ready for this…not gonna be pretty! Oh, by-t/-bye, I have rented my room, shared house, for 8 yrs, inside t/ GTA, just outside of Toronto, for just $400/mth…all incl w/ HS internet. Deals are out there, but, few and FAR between!

ok first off the median household income in toronto is 90k. Less than 2 percent in ontario earn over 200k. a crap hole in a decent area is 1.2 million or 600% the income of the top 2% in the country, the median household income of residence owners and non in that area is 80k or almost 300% less! Please do remember these are all worthless GROSS income figures which mean nothing their net income as we reside in canada and not china and pay income tax, so it is more like 50K after paying income tax or 4k a month! Umm, a tear down at 1.2 million which will require renos, upkeep, rot, mold, plumbing leaks ect each year which costs 10 to 100k easy. Now even if you are in the top 2 percent of income earners in the country and go for 200k congratulations, you net 110 at best and you can buy a crappy home in a neighborhood where your neighbours earn 80k. must feel nice paying over a mil for a crappy house in an area where your neighbours and home owners are borderline poverty living . This is all because of Chinese Flippers 100 percent. Same crap in Vancouver, in east van the median income of households is 50k and you have to pay 1.3 for a crappy house, in a crappy neighbourhood and be in the top 2% of income earners in the country… This bubble will burst and badly, home trust just came out with all the scam loans its been giving out shares tanked 60%, BMO is bundeling mortgages and selling mortgage backed securities exactly what happened in 2005 in the us, median house hold debt to income is 170 it was 157 pre 2007 . Chinese are loosing interest and pulling money out and and 2017-2018 will be a massive drop in prices and no one will want to pay 1.2 for a crap house in a crap neighbourhood in toronto or vancouver which makes skid row look high end.. It is criminal what the govt in canada has done. You can go to LA where you feel like a boss and go to the hollywood hills high end buy an old house and live amongst ppl who are top and feel like you paid 1.2 million unlike the toronto and vancouver chinese raped housing market most of who are not citizens and have zero interest in living in canada or in the home and had just bought to flip for more the next year and on and on and on to create a massive bubble massive social problems for locals and then efff off……disgusting. This is all due to mainland and hong kong Chinese and the disgusting treasonous govt of Canada. Most of the chinese in vancouer who bought in the past 3 years have lost all their equity and not happy, try selling a house in west van or west side, listings over 3 mill have been sitting for 1 year and reduced anywhere from 400k to 4 million no buyers, chinese know their money will go bye bye if they buy and the ppl who put down 2 mil got a loan for 4… i knew lots and paid 6 at best can get 4 right now which means their 2 mil is gone bye bye sayonara…..also all the chinese builders on the west side who bought tear downs at 2 and built at cost of 500 to 900k hoping to sell for 3.5 and make 600 to 800 are now sitting with zero interest and lowering prices to 3.3 3.2 3.1 and getting offers in the mid 2s!! Not so nice one big boi….take ur money and efff off outta canada bye bye….the same exact thing is now happening in toronto this week and all the stupid price gains caused by CHINESE in the past 2 years will be earased…

and it is a pure lie scam and myth that the chinese are so rich “they just buy cash” my rear end they do, i know tons of chinese mortgage brokers and a few have specifically told me over drinks, ya, no, all chinese take out morgages and some high ratio and tell them to “not tell anyone in the community” to keep face and keep the market sentiment up to make ppl feel the market is solid because of “rich chinese” this is not true, 1 percent of the chinese buyers are rich the rest have just jumped on the band wagon and pretended they are and played the game in hopes of getting rich…this is going to end very badly as it should…….all cash my rear, if its all cash why are all pptys bought in van on title with mortgages on them! lying snakes……bubble bursts i guarantee you the chinese will be the first to default left right and center…. i went to van 4 months ago a chinese was askin 2.5 for a 40 frontage in point grey, it went for 1.65…lol….so much fake news……..btw trusting a a realtor is as good an idea as trusting a pedo with your child….all of them are lying rats…the whole lot of them….

[…] of Finance (MoF), high ratio mortgage borrowers are extending themselves to the limit. While we covered how concerning this trend has become in Toronto, it’s not just isolated to that city. It’s a trend that’s growing across all […]

[…] of Finance (MoF), high ratio mortgage borrowers are extending themselves to the limit. While we covered how concerning this trend has become in Toronto, it’s not just isolated to that city. It’s a trend that’s growing across all […]

[…] of Finance (MoF), high ratio mortgage borrowers are extending themselves to the limit. While we covered how concerning this trend has become in Toronto, it’s not just isolated to that city. It’s a trend that’s growing across all […]

[…] of Finance (MoF), high ratio mortgage borrowers are extending themselves to the limit. While we covered how concerning this trend has become in Toronto, it’s not just isolated to that city. It’s a trend that’s growing across all […]

[…] of Finance (MoF), high ratio mortgage borrowers are extending themselves to the limit. While we covered how concerning this trend has become in Toronto, it’s not just isolated to that city. It’s a trend that’s growing across all Canadian urban […]