Canadians have seen their net worth soar over the past couple of years. Now the market is taking back some of those gains, according to Statistics Canada (Stat Can). In Q2 2022, a sharp drop wiped out virtually all of this year’s gains. The wealthiest households have seen an average of nearly $200k wiped off their net worth.

Canadian Households See Average Net Worth Fall Under $1 Million

Canadian households have seen their average net worth return below the million mark. In Q2 2022, the average net worth fell to $940,600 — down 6.5% (-$65,400) from the last quarter. The lowest and second wealth quintiles had an average net worth of $64,800 in Q2 2022, down 12% (-$8,800) in the quarter. It’s the largest decline as a share, but the average household lost more than this whole demographic had.

Canada’s wealthiest households took a big hit this year with the first quintile (top 20%) losing hundreds of thousand. Stat Can estimates their net worth dropped $199,100 between Q1 and Q2 of 2022. It was financial assets (-$123,100), and real estate (-$78,500) that represented the bulk of losses. A minor increase was seen in some smaller segments, helping to reduce losses from those two areas.

Younger & Older Households Took The Biggest Hit

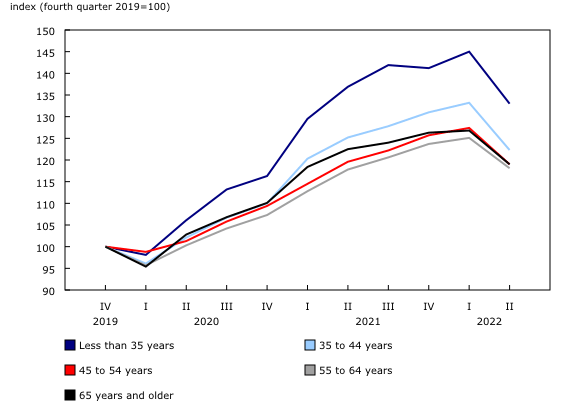

Canada’s oldest and youngest households saw the largest declines in net worth, when it came to age. Seniors 65 and older saw the change in their annual net worth fall 2.86% in Q2, taking the top spot by a hair. Those younger than 35 saw a loss of 2.85% in Q2 2022, rolling back more than a year’s worth of gains to Q1 2021 levels. Relatively small pull backs in contrast to the gains made, but it’s also happening very fast. Only one age bracket (55-64 year olds) saw gains, but they were relatively minor (+0.25%). Increases are better than no increases in a down market, though.

Change in average household net worth by age group of major income earner

Canadian Indexed Household Net Worth Change

The indexed value of change for household net worth by age group.

High inflation has forced interest rates to surge, and that’s cooling demand. This pushed prices lower for most asset classes, especially housing. However, the gains made since 2020 were so lofty, it’s not much of a price roll back. Easy come, easy go. At least part of it.

you ain’t seen nothin yet

VERY NICE. KEEP FALLING

They can always charge $800 a month to rent out a shared bedroom inside their laundry room, requiring income verification, employment letters and credit checks.

Thank you politicians for turning Canada into a post-urban hell.

If the ‘gains’ were not realized, can they actually be considered lost? It was all hype. I paraphrase the bank slogan with ‘You’re poorer than you thought’.

Turdeau singing: “easy come easy go little high little low”

Everything’s getting slaughtered except the USD. Good for you if you held some USD. Or even better if you held American oil stocks