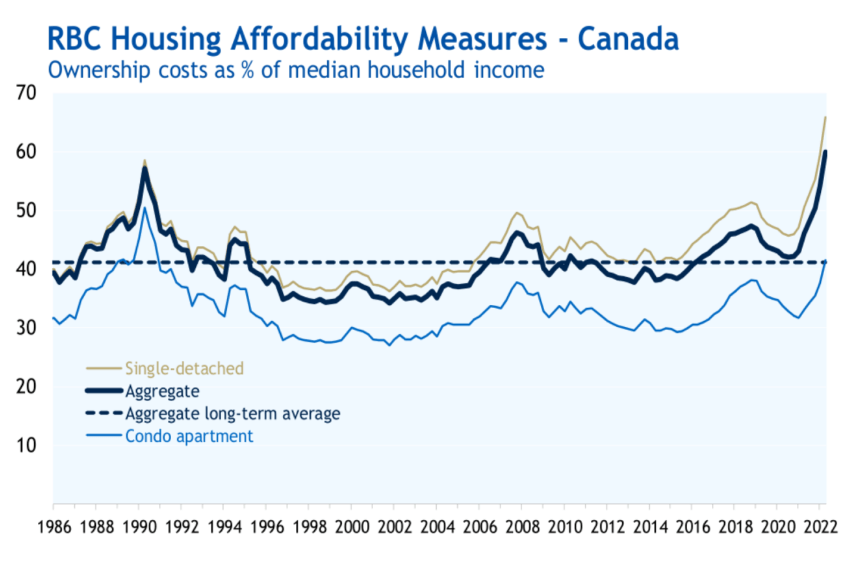

Canadian real estate has never been less affordable, according to Canada’s largest bank. RBC warns housing affordability eroded to its worst level on record in Q2 2022, with households now requiring a record share of income. Despite falling home prices, affordability is still eroding due to rising interest rates. However, the bank sees home prices falling further to adjust to higher rates, and affordability to improve as early as next year.

Canadian Real Estate Has Never Been Less Affordable

Canadian housing affordability has reached the worst point it’s ever been. A household now requires 60% of its income just to service a mortgage in Q2 2022. It surpasses the previous record of 57% hit in the 90s, and that’s just at the national level. The bank warned it’s even worse in Canada’s largest cities.

A record share of income is required for a typical home in Toronto (83%), Vancouver (90.2%), and Victoria (67.6%). Ottawa (48.5%), and Halifax (41.3%) are also unusually high, they just seem small in contrast to the big three markets.

The trend is universal, right across the country “While the situation isn’t as dire in other regions of the country—in fact, many markets in Alberta and Saskatchewan, and some in Atlantic Canada still look reasonably affordable—the rapidly deteriorating trend is universal. A rise in RBC’s measure represents a loss of affordability.” said Robert Hogue, RBC’s deputy chief economist.

Falling Home Prices Will Restore Affordability

Periods of such extreme unaffordability don’t typically last for long, and RBC emphasized that point. They expect home prices will lower the pressure on budgets, more than reversing the climb of higher interest rates. “We expect benchmark prices to fall 14% nationwide by next spring— more so in Ontario and BC,” said Hogue.

Towards the end of next year, they expect affordability will have improved significantly due to price declines. However, things will get worse before they get better. “… the likelihood of further rate hikes from the Bank of Canada is poised to intensify affordability pressures before then,” warned the bank.

Restoring affordability and a healthy market should be the highest concern, to preserve the long-term viability of the market.

Sure, if one’s got a million or two in cash stashed away ready to deploy at a moment’s notice.

The reality is that rising interest rate and rent are calcelling out any inprovement in affordability.

The kind of housing I can afford to has NOT changed even though the housing price has dropped. I am just bleeding more money to rent while I wait for that magical house affordability to appear.

Drop the house prices AND drop the interest rates then we’re ‘talkin

Doesn’t take a genius to see that house affordability has not improved.

The only ones better off are the banks

anyone who owns outright will be fine – millions in a personal foundation or offshore account even better, wait for the bottom and buy all the peasants out – then turn around and rent it back at the most exorbitant possible rates ahhh like da good ol’ days! Only in the last century has a working man even dared to own his own home. We go back to lairds and serfs

Any collapse in the real estate market will most likely mirror the extraordinary rise we have experienced over the past few years, and that’s just math and market history. Mean reversion is real, timing it is the hard part.

As well, affordability is irrelevant when the market is in free fall as only experienced buyers will be interested and they will wait for a true bottom…PLUS, getting approved for a 6% mortgage will require bullet proof balance sheets because banks are going to be quite busy writing down risk from their massive lending books and adding new loans isn’t going to be a priority for them.

I don’t know when this ends…I just know it ends badly.

To boost real state activities n overcome deficiencies of housing, the Bank shd also ponder about introduction of option of repayment of house margage on rental basis besides financing on interest. The cost of a house for those who opt for rental basis plus rental value for the period of repayment be determined dividing the total cost + rental by the period of repayment of loan n monthly

installment be arrived at n fixed for the entire period involved. Various communities

avoid financing on interest basis. Such system is learnt to be in place in UK. This wd motivate such people to invest in housing sectors bring the capital in market which at present is unmobilized/stuck up.

Didn’t you read the article? These things take time – sellers are not yet facing the reality that they cannot sell for last spring’s prices. Until desperation sets in, house asking prices will remain stuck and therefore sales numbers will keep falling. No sales = no lower comparables = no documented price drops.

Hopefully interest rates will remain this high for the next year (dare I hope for a lot longer?) and that will slowly bring prices down and thus improve affordability again.

Because the interest rates were so low, and the morgage sizes are so large: 700k to 1M+, the affordability increasing effect of lower house prices is cancelled out and then some by interest rates rising 0.75% every month.

The longer you wait the more you pay still holds. More or less.