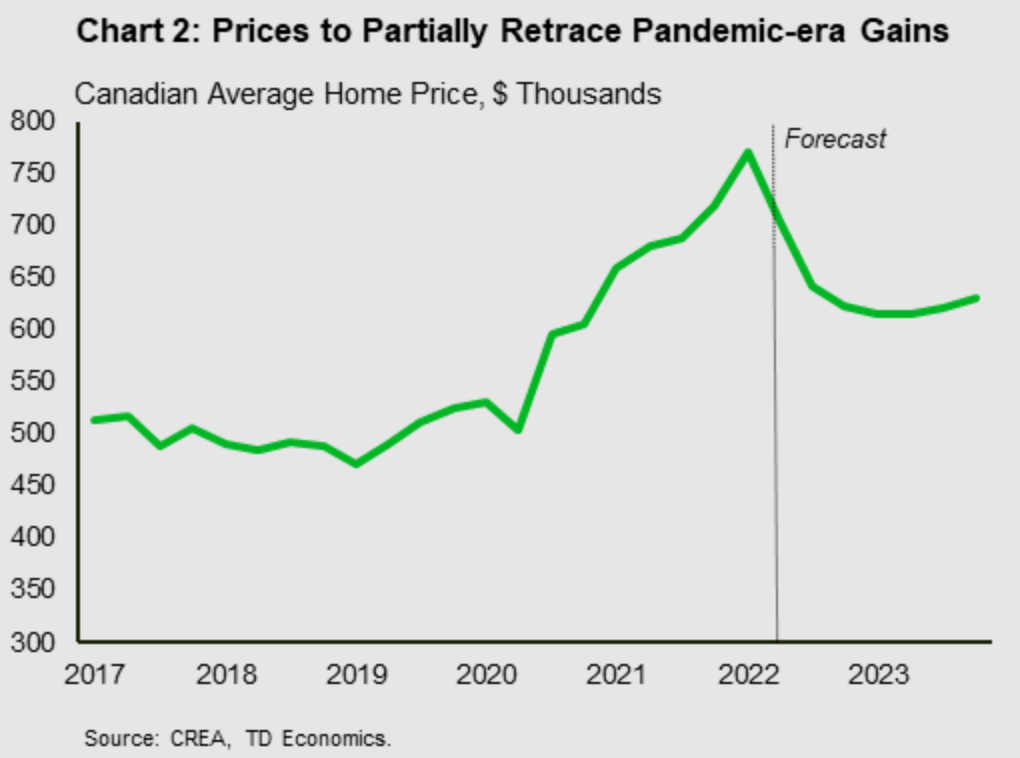

Canada’s second largest bank sees lower home prices in your future — as long as you’re in BC or Ontario. TD Economics updated its price forecast following its downward revision on home sales. Economists at the bank now see an “unprecedented” drop for home prices, largely concentrated in more expensive markets. Even with the decline they don’t see all of the price growth seen since 2020-rate cuts, rolling back.

Canadian Real Estate Prices Forecast To Fall 25%

TD is calling a sharp drop for Canadian home prices after the huge pandemic run-up. Their forecast Q

It’s a substantial drop in home prices but not enough to correct the run up following 2020 rate cuts.

“Our forecasted decline in national home prices would only partially retrace the 46% runup over the course of the pandemic,” explained Rishi Sondhi, an economist at the bank.

The largest price drop in history doesn’t wipe out the price increase over the past two years, which says a lot. Running the numbers, that works out to retaining around 10% of gains over three years, roughly the return of target inflation. After a year of elevated inflation, some markets will be lower in real terms.

An “Unprecedented Decline,” But It’s Just Recalibration

Canada has never experienced a price correction this significant, but it won’t be a violent market event. “Our projected price drop represents an unprecedented decline (at least from the late 80’s onwards, when the data began). However, it follows an equally unprecedented runup during the pandemic,” said Sondhi.

Consequently, the market calls it a “recalibration,” referring to the impact in prices due to financing. It seems like an apt description of their forecast, since they don’t see prices returning to the all-time high in the medium-term. A higher cost of financing is expected to throttle home prices going forward.

Canada’s Real Estate Correction To Be Largely A BC & Ontario Story

Looking at national numbers tells us more about the economic impact than prices. Most of the price correction will be concentrated in BC and Ontario, according to Sondhi.

They expect only small spillovers into other regions like the Prairies and Atlantic Canada. Those markets are priced significantly lower and thus less sensitive to interest rate hikes.

TD is the latest bank to call falling home prices after the huge run-up over the past two years. None of them thus far expect home prices to rollback the entire gain, and none see a significant recession. However, some have explained the slow recovery back to the all-time high will allow some relief on affordability as wages catch up.

The Bank is wrong. Expect a correction greater than 25%, price drop. Interest rate’s normalizing at 5-7%. Will significantly change the correction. Canada hasn’t seen 5-7% rates since 2008 (14 years). Expect ( opinion), 50% crash in sales, prices by 2025. The market will decide.

Haven’t prices already dropped 22% since Q1 2022? Why are they “predicting” something that’s already happened?

If you’re moving foreign money into Vancouver and Toronto real estate, there was a promise of significant returns on investment. So are interest rates scaring investors away, or has the hype faded and forced the Canadian taxpayer into finding affordable housing/rent? Warehousing citizens is Canada’s new economy. Innovation, intellectual property and new disruptive technologies to compete on the global stage are far behind the warehousing of people.

Could it be we will see a mass exodus from investor havens like BC, Ontario? As all the gold has been picked ?

It doesn’t scare investors away. In fact it’s a better opportunity for investors. Foreign investors usually buy on cash so the interest rates are meaningless.

A recession lasts 12-18 months and it’s an opportunity for them to get a 50% return in 18 months.

Golden opportunity for the rich (as always)

Canada is a big country with many real estate markets that differ in their supply and demand situations.

So to generalize the entire country like this just makes me skip the article

Look at a map with population density. Canada is a small country with a vast uninhabitable hinterland with a real estate addiction and ageing problem. It’s like getting bone cancer after a cerebral palsy as a kind of terminal condition buy 1 get 1 free.

it’s so funny to hear about housing shortage, when a lot of so called investors, in huge debt, but owning 3,4,5 properties and screaming about that shortage, hopefully BOC soon enough raise rate to 7 or 8% to correct inflation and after those investors will sell properties for any costs and housing market will automatically improve inventory, will be no shortage.

But It’s Just Recalibration. Unless you bought in January. I talked to a banker the other day. They are calling variable mortgages in to tell them it will be 65 years to pay off unless they increase payment.

My learnings so far from media….

Reasons for increase in real estate prices

First low interest rates.

Second people wanted bigger homes for work from home option

Third it was supply demand of real estate property

Fourth, General understanding is to Buy a home now because price will keep increasing and you will not be able to buy it.

Once the gas runs out and the BOC woken up, interest rates raised, prices corrected, now advidors in media are encouraging to get money from parents to buy home.

Financial institutions forecasting drop in prices…

People/investors had more money to buy homes they chased the property for quick gain and not for living, I could still see lot of dark empty houses which are kept away from hard working people to buy it at reasonable prices.

What next??? Let’s wait and watch.