Canadian real estate markets are fully in a downturn and things are going to get worse before they get better. This week, Canada’s two major real estate markets reported falling home prices and sales for July. It comes as more households expect home prices to fall than rise, which hasn’t been the case in a very long time. To add another squirt of gas on this dumpster fire, BMO Capital Markets reminds us the last rate hike wasn’t even a full month ago, so it has yet to be fully reflected in the data.

Canadian Home Sales Are Falling Very Quickly

Toronto and Vancouver real estate markets tend to lead being the big two, and the picture isn’t great. Both cities have seen a sharp drop in home sales, with Toronto down 47% last month, and Vancouver 43% lower. Inventory levels have only made minor improvements, but falling sales has “balanced” the market.

Home Prices In Toronto and Vancouver Cratered Last Month

Home prices in both of those cities also declined sharply. The benchmark price of a home across Greater Toronto fell $47,500 in July. Over in Vancouver it fell a smaller-but-still-large $28,500 over the same period. Fast falling Southern Ontario, in the areas around Toronto, are seeing the most rapid price drops warns BMO.

“Prices continued to fall in both markets in the month, with parts of Southern Ontario beyond the GTA still looking like the hardest hit,” said Robert Kavcic, a senior economist at BMO.

The bank warned the price drops are only getting started, with the last rate hike not fully priced in at market. “Recall that the BoC’s 100-bp hammer blow came mid-month, so more weakness lies ahead,” he said.

More Canadians See Home Prices Falling Than Rising

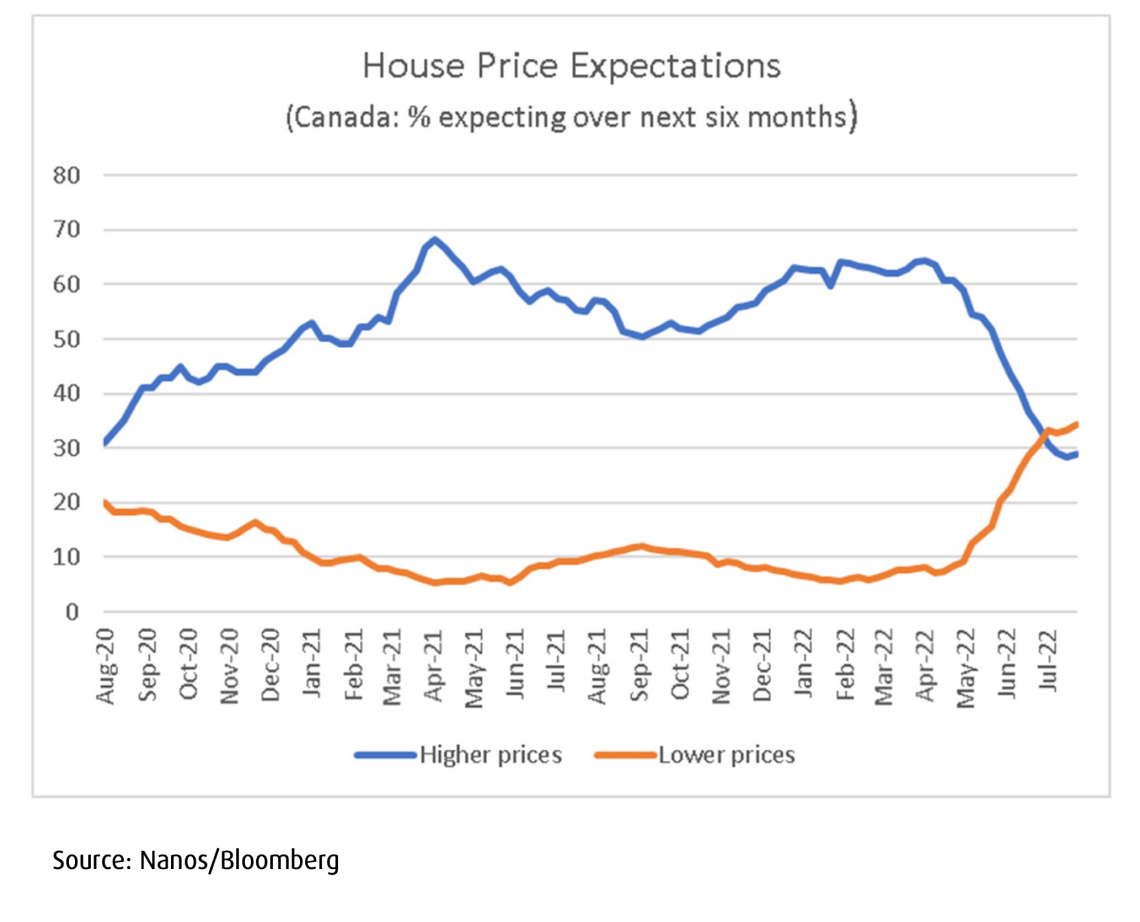

At first the market just rolled with the negative indicators, but households are now taking note of the issue. “Notably, more Canadians now expect home prices to fall than rise over the coming months, a sudden turn from the raging self-reinforcing optimism seen through 2021,” explains Kavcic.

Just a few months ago, it was almost impossible to find someone who thought prices were going to fall. Now more people see prices falling over the next six months than see them rising. “The reality that Q1 pricing is long gone is now setting in for Canadians, as market psychology has turned dramatically,” he says.

As a HUDAC, ONHWP, Tarion builder since 1986, I can attest that this is the real deal. The crash of 1990 will pale in comparison to this generational shift in residential housing now upon us.

The future holds an unpleasant deleveraging for those unfortunate enough to have overextended into this maelstrom of excess.

exciting times, lets see how low can they go, i wouldn’t pay more than 200k for a 4 bedroom detached house.

Niagara, Brantford and Kitchener-Waterloo prices are in free fall.

I wish I had a dollar for every time I heard over the past 50 years that single family house prices in the lower mainland are going to drop 20% or more.

Because then you could buy a detached home on the West Side after it fell over 20% in 2017?

The only ones benefiting from this “correction” is the banks and the government. The government does not care about its people and this is proof. Housing was already ridiculous, so instead of paying for or selling your house at a higher amount, you now pay lower but pay an insane amount of interest for the same house…which just keeps the unsustainable rent/mortgage rates. Wonder who wanted this? The greedy ass banks and government.

Insane amount of interest? Historically speaking, the insanity was near-zero interest rates. What we are seeing now, and what is to come, is only a normalization of things. The true profiteers of the housing bubble/inflation were not moms & pops but 1. very wealthy owners of multiple properties and 2. senseless speculators overleveraging themselves to profit from the low interest rates & rising prices. The latter have caused this mess and will now suffer most from the fallout, as leverage is a boon going up but a bitch going down.

& your argument for why higher interest sucks (lower principal but higher interest means the same payment for the homeowner) applies just as much to the banker. The size of their loans matters in the $ they make. But the counterparty risk they take on right now is huge and I am sure many banks would be scared… If only the Canadian govt did not provide it’s stupid mortgage insurance.

Ugh, not going to get my hopes up – endlessly creative BoC and politicians will find yet another way to turn this around and again put off the much-needed and long-overdue Canadian housing crash and deleveraging. By the time it finally comes, (not this year!), it’ll destroy our economy for a generation.

On a 10 year downtrend so a long as you bought long term don’t worry.