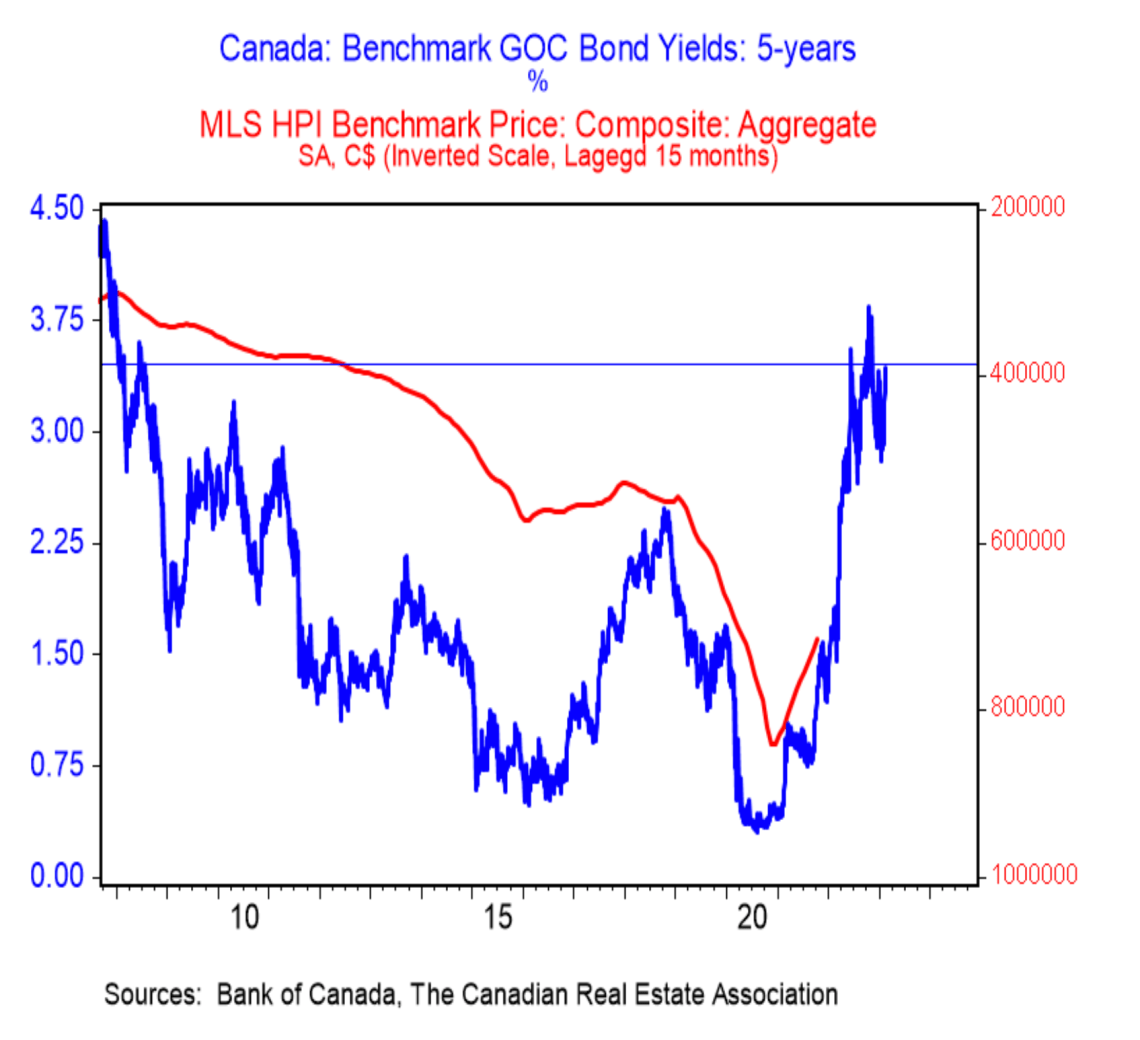

Canada’s rising bond yields are set to drive mortgage rates higher, as fears of a recession are put aside. The Government of Canada (GoC) 5-year bond yield hit a new multi-month high on Friday. Yields have suddenly reversed course, as economic data has been coming in much hotter than expected. Canada’s oldest bank sees this as potentially driving home prices lower, pointing to the close relationship over the past decade.

Government of Canada 5 Year Bond Yields & Mortgages

Since credit markets are competitive, Government bond yields influence interest on similar terms. When yields rise or fall, the cost of borrowing for a similar term isn’t far behind. The most notable is the 5-year GoC bond, which directly influences the 5-year fixed rate mortgage. It was the most popular mortgage product until the recent record-low rates, when people began chasing variable mortgages.

Canadian Bond Yields Surge, Hit A New High For 2023

Canadian bond yields have been surging over the past few weeks, as inflation fails to cool as fast as intentions. The GoC 5-year bond closed at 3.45% on Feb 16, 2023—a new high for 2023, and a level not seen since this past November. At this level, the market is facing similar conditions to those seen in 2008.

It might be heading higher too. This morning, the GoC 5-year yield reached 3.537% and is on track to close at a new multi-month high. It’s a big change from a few months ago.

Up until three weeks ago, the story was falling yields. In mid-January, the GoC 5-year yield had fallen to just 2.8%—reversing nearly half a year worth of climbing expectations. Over the past month, it’s added 55 basis points (bps), ripping higher.

Solid Economic Data Is Driving Yields Higher & Home Prices Lower

Falling yields were triggered by softening expectations. The market had expected more indicators typical of a recession to appear, such as eroding employment. That hasn’t occurred, and some would argue the economy is actually fairly robust with strong employment.

“The rise in yields reflects a run of solid economic data in both economies, and the dawning realization that central banks may need to do even more than expected just a few short weeks ago.” explained Douglas Porter, Chief Economist at BMO.

In a research letter to BMO Capital Markets clients last week, he touched on the implications for the housing market. Plotting home prices shifted 15 months earlier, against an inverted axis—he demonstrates the close relationship rates have had on home prices since the mid-2000s.

“The rise in fives has big implications for an already struggling housing market. The inverted chart of home prices is meant as an indication of the lags involved —not to suggest prices are going to revert that much. But note that even with the correction of the past year, home prices are still up 30% from the pre -pandemic level.”

Despite talks of falling prices, remaining 30% higher isn’t exactly the hardship that’s often presented.

The idea that higher rates will bring down housing prices is a mistake. While it may temporarily push out buyers from the market, it will increase rent and the price of new builds in return. Furthermore, there will be fewer new build houses in the market, and with more potential buyers waiting for rates to cool down, house prices will inevitably surge due to accumulated inflation on commodity prices and fewer new build houses.

The current inflation has several main reasons: supply chain issues, money injection during COVID, processes put in place during the pandemic that have not been removed, and geopolitical issues with Russia and China causing Ukraine to be kicked out of the supply market and raise the price of shipping from other Eastern suppliers. All currencies have lost more than 30 percent of their value, but we don’t see it because they are compared with each other.

In conclusion, rate hikes will only make people uncomfortable and inject poverty in the long term. The Bank of Canada and politicians must work on bringing down oil prices and shipping costs. A rate hike will only make the situation worse, and it is crucial to take action to address the root causes of inflation.

Even the BIS said that was wrong, but okay. Canada’s head of bank regulations fully said cheap credit was sapping investment from productive areas, and so did RBC—but what do they know.

Don’t you think that getting off oil would be a better thing to do

Why must the government do anything? The notion that a group of paid employees work in the best interest of the 99.9% of the population is hilarious.

“… with more potential buyers waiting for rates to cool down, house prices will inevitably surge …”

Nonsense. Demand is even lower than supply because people can’t afford to pay the 2022 prices sellers are demanding.

Hehehe, what you wrote is very wishful. It appears that you are the owner of a home bought at a peak. High rates and QT will fix the broken housing market that the Bank of Canada created with its depressed rates and QE

what you wrote is very wishful. It appears that you are the owner of a home bought at a peak. High rates and QT will fix the broken housing market that the Bank of Canada created with its depressed rates and QE

WTF do you mean “bad news?” How are we defining bad?

The target areas to deal with are the issues that affect the. 85%. High rents. And high food costs , versus low earnings These do not compute

If we need to bring immigration to canada then we need to guarantee a cost of living geared to income. Not a cost of living in devoid of income

And it must be based on these 2 main structures

For if we cannot afford to put a reasonable roof over our heads. And put a reasonable meal on the table we have nothing to offer new immigrants. Let alone our existing population

These are the fundamentals of life

And the building blocks , everything else will fall into place behind these

At the present time average rents are occupying as much as 45% of gross incomes And food is bordering on 13%

This is not manageable and now we have interest rates that are compounding the issues