Canadian real estate has entered a bear market as monetary stimulus fades. BMO Capital Markets wrote to clients to explain home sales fell further in July. Falling sales helped inventory recover, resulting in a balanced market. It’s not expected to stop there, as provinces like Ontario show rare weakness. This has the bank seeing the market erode further in the coming month.

Canadian Real Estate Demand Is Cooling, Helping Inventory Recover

Rising rates and falling Canadian real estate sales helped boost months of inventory. The seasonally adjusted inventory of unsold homes reached 3.4 months in July, up from 3.1 months in June. It’s almost twice the 1.7 months at the start of the year, the bank emphasized.

“That’s getting back close to the much calmer conditions prevailing just before the pandemic when they were a bit above 4 months’ supply,” said Douglas Porter, the bank’s chief economist.

Canadian Real Estate Is A Balanced Market, But Getting Worse

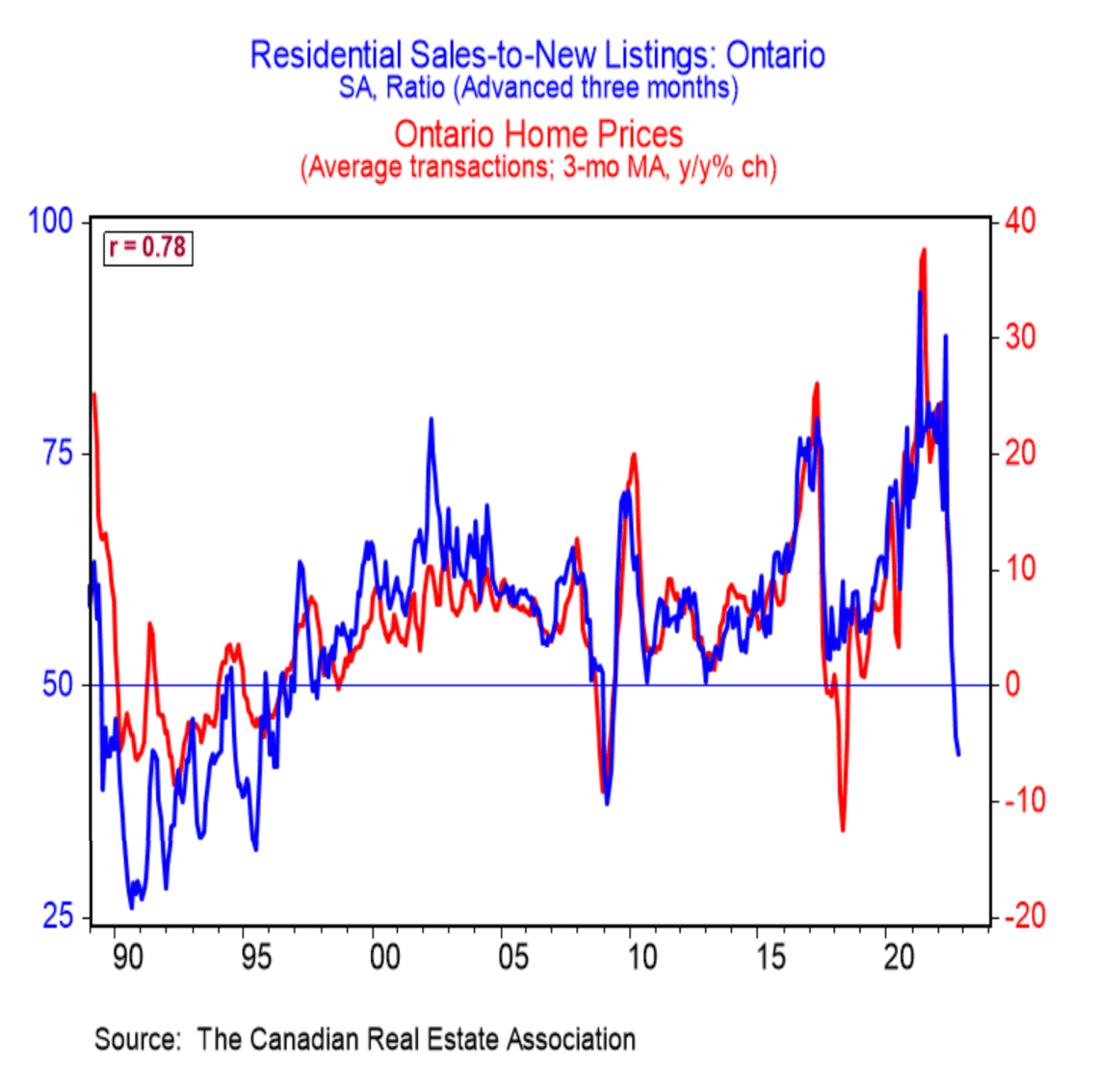

The sales to new listings ratio (SNLR) helps to make more sense of this trend. This is the ratio of homes sold compared to the number listed for sale. Right around 50 percent is balanced. If the ratio rises above 60 points, the market is a “seller’s market,” where prices tend to rise. Below 40 percent and the market is considered a “buyer’s market,” and prices tend to fall.

“A metric that’s a bit more concerning for the near-term outlook is the ratio of sales to new listings, which has plunged to just above the 50 [percent] level after holding well above a record high 75 [percent] for all of 2021,” explains Porter.

Ontario Real Estate Rarely Sees Such Weak Demand

Ontario has seen the biggest dip, with the ratio falling to 40% — a level it has only seen once before in the past 25 years. That was during the 2008/2009 downturn, when the market slowed though it didn’t particularly see a big dip, having only recovered to 1990-levels in real terms at this point.

The above chart shows Ontario’s average home price growth and its SNLR. BMO estimates the SNLR leads home prices by 3-months, so they pushed it forward by that much. The result is a picture that appears to be getting worse.

Porter explains, “prices have famously started to drop in many Ontario cities in recent months, including the GTA, but they’re still up a tad from a year ago. This ratio says there is more weakness coming, and soon.”

Shouldn’t have been borrowing 100k from mommy and daddy to buy a house. Ooops!

The Bank of Canada CAN NOT allow this and should lower rates immediately.

The government should create a homeowner recovery benefit since they are messing with interest rates and causing this.

It’s literally the opposite. They’re removing their state-injected liquidity that was suppressing rates, and the market is now determining the price of interest.

Variable rates are supposed to be in line with market expectations. They weren’t because Tiff was comfortable setting a trap for the public. State intervention is what breaks the market.

Queue the RE bulls comments of “400k new immigrants next year” blah blah.

I’m sorry, but people will think twice before coming here to pay 500k for a studio.

The greatest bubble ever is deflating – in six months, it will collapse as the onion layers of leverage is peeled away.

It’s telling that the banks and the Real Estate Boards describe the situation as about to get ‘worse’ when, in fact, it will be much BETTER from the perspective of previously priced out buyers.

The million dollar question (or in much of Canada, the multi million dollar question), is when the BofC re-stimulates.

By now it should be clear that although supply plays a role, the overwhelming driving force behind home prices in Canada is the central bank. When rates are low or falling, prices rise… when rates are rising they fall. This is because 1) relative affordability function based on the cost of debt, but primarily because 2) INVESTOR DEMAND… this is they key… when rates are falling (or below inflation), capital flows into houses, increasing demand, increasing prices.

Not many places in Canada provide cash flowing real estate.. investors enter the market counting on appreciation. At this point in the game the central bank essentially controls the market. Let’s see how long they allow home prices to fall before they think “oh shoot, GDP is contracting, we need to pump this sector again”

I sold my homes in Nov. 2021, I knew after inflation started picking up that the BoC would have to raise rates and match our Southern Neighbours. Interest rates aren’t coming down in the next four to six years as the BoC would have to bring down inflation rates, I don’t see that happening unless the the BoC raises rates to 9.5% atleast at our current 7.6% inflation rate. Winter is coming and energy demand will rise & OPEC+ pushing prices higher, probably pushing inflation even higher. Ladies and Gentlemen it was an awesome 25 years in the real estate industry. See you in 2026. Now it’s time to invest in hard money. Don’t let your cash evaporate in thin air.

A bear market occurs when a market experiences prolonged price declines. “It typically describes a condition in which securities prices fall 20% or more from recent highs amid widespread pessimism and negative investor sentiment,” writes Investopedia.

Economy will crash in late September .If your deals aren’t closed by then people will walk .There may be many rent to buy deals for first timers to get a down payment and buy at a later date .Depending on a motivated owner