Canada’s late 1980s real estate bubble was so big it resulted in a correction lasting over a decade. That might have been small in contrast to where the current one is heading. BMO senior economist Robert Kavcic says affordability is currently stretched with low rates. As rates go through normalization, the bubble is expected to eclipse the last one.

Canadian Real Estate Rivals The 1980s Bubble

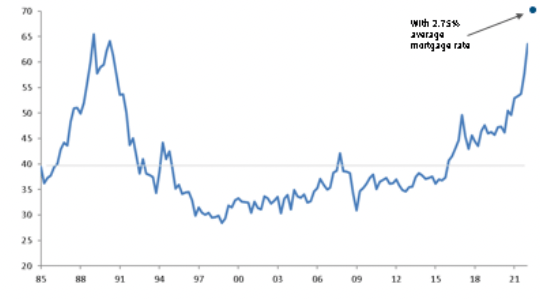

Despite low rates, Canadians need nearly the largest share of income ever to pay a mortgage. No, this isn’t just in places like Toronto or Vancouver. Right across the country, home prices are rising tens of thousands per month. Affordability is stretched everywhere, but BMO used Ontario for the comparison. This is most likely due to the well-documented boom-bust cycle its market has seen before.

Looking at the share of income needed to carry a mortgage, they found it was near the record. In February 2022, households needed to devote a share nearly as high as Canadians in the early 90s. “And, that is based on still historic low mortgage rates,” said Kavcic.

Canadian Real Estate Likely To Surpass the 80s Bubble

Mortgage rates are set to climb very aggressively over the next few months, and that will erode affordability. The bank estimates the current average mortgage rate at a near-historic low of 1.9% and compares it to modest increases. At least one of Canada’s biggest banks sees interest rates rising another 250 basis points (bps). BMO is modeling just 100 bps, less than the consensus for these numbers.

“If we assume that variable rates rise 100 bps, and fixed rates grind up another 50 bps (those are probably low-end assumptions), then the chart shows where valuations will get stretched to—above late-1980’s levels,” he said.

Ontario Real Estate Affordability

Mortgage payments as percent of income required to carry an average home.

Source: BMO Capital Markets.

Canadian Real Estate Bubble Risks Are Adding Up

The consensus estimate for the BoC overnight rate is more than 100 bps higher by year-end. BMOs calculations also aren’t factoring in any more exuberance, which is unlikely. Current momentum has prices rising by thousands per day. It would have to be a big shock, for a market already at risky levels. “Housing valuations are stretched heading into a series of rate hikes. Is the market at risk? Could be.”

The current real estate market looks like the late 80s bubble on steroids, in more ways than one. Whether it ends up the same will be a mystery, but don’t dismiss the possibility due to some popular narratives, they hint. “There are many similarities: Demographic boom, inflation and speculation. We’ll have to wait and see about the outcome…”

Where is the report/statement that BMO put out saying these things? Please provide a linkable reference.

I’ve asked this before. BMO sends the reports to journalists a day before so they can write about them and then the report goes to capital markets customers afterwards. There is no report to link to, and I confirmed with BMO.

I am glad that you mention “right across the country.” We live in a small town (<5000) near Sudbury and the prices here have soared. It also only has one major employer in a commodity industry. A renovated 850 sq foot 2 bed 1 bath no basement was listed at 299k and was quickly sold. Three years ago that probably would have gone for around 100k. The wages in this town, while decent, don’t support that – GTA wages are driving the increase – “getaway/weekend homes” or “retire to homes” etc. Local supply/ demand didn’t drive up the prices.

In Eastern Ontario the house across from my mother’s, all original 1971, was listed close to 600k, in a town where the vast majority of job postings are the “light industrial “ type for $18/hr. The attention may be focused on TO or VAN, and the absolute numbers may be higher, but the impact on price to income ratio feels much sharper in the smaller communities.