Canadian businesses are optimistic about the future, but inflation and wage headwinds are brewing. The CFIB small business confidence survey showed improving confidence in March 2022. It also reveals their expectations of high inflation are rising further. Despite higher inflation, businesses have lower expectations for future wages, a toxic combination.

Canadian Small Business Confidence Gets A Boost

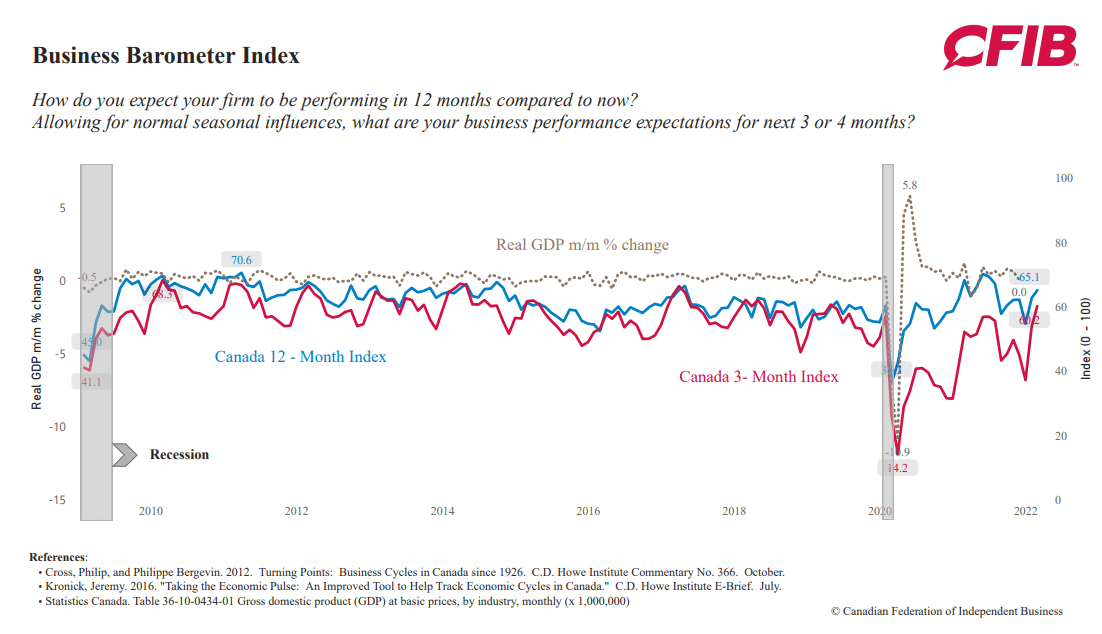

Small business confidence is flying higher, albeit a little lower than it was last year. The index for business confidence for the next 12 months climbed to 65.1 in March, up 2.4 points from a month before. This is down from the peak reached last year, but higher than it was in 2019. It’s definitely the sign of an economy that’s past the need for stimulus, but costs are spiraling.

Canadian Small Business Confidence Is Rising

Small business confidence for the next 3 and 12-months.

Source: CFIB.

Canadian Small Businesses Expect Significant Inflation Next Year

Businesses aren’t buying into central bank talk of tackling high inflation. The average small business owner expects their average price will climb 4.7% in twelve months. March was the highest the index has ever been, though it only goes back a little over a decade. A lack of confidence in the central bank’s ability to control inflation makes it harder to control.

More Inflation But Less Wage Growth

Small businesses expect one cost to slow over the next 12-months — wages. Businesses are forecasting wages will climb 3.1% by next year, just under expectations from 3-months ago. Wage growth is forecast above inflation targets, but falling. A fairly big problem to see emerge.

Canadian Small Business Price and Wage Growth

The expected change in cost for prices and wages at small businesses over the next 12 months.

Source: CFIB.

Overall optimism is improving but there’s a couple of very important headwinds in this data. The first is inflation expectations are increasing, not reversing. Small businesses don’t appear to see central banks able to control inflation in the near term.

The second takeaway is wage growth isn’t expected to keep up with rising costs, and that’s going to be problematic. Wages generally receive inflationary pressure until inflation cuts into the ability to pay more. If this follows through, the economic environment is likely to become a little uncomfortable for everyone.