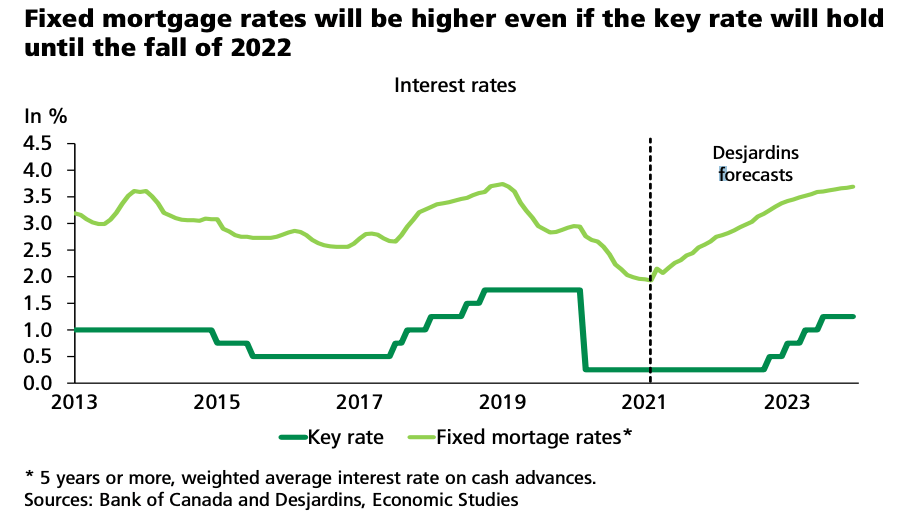

A large Canadian financial institution sees higher mortgage rates in your future. Desjardins’ mortgage forecast shows they expect mortgages to continue to climb from here. They see 5-year fixed mortgage rates hitting pre-pandemic levels by next fall. That is before the first expected hike to the overnight rate from the Bank of Canada.

Canadian Mortgages Forecast To Rise Before Hikes

Even if the Bank of Canada (BoC) holds the overnight policy rate until Fall, mortgages will creep higher. Desjardins sees the 5-year fixed-rate hitting 3% by Fall of next year. This would be an increase of almost 50% from the end of last year. At that number, the 5-year fixed mortgage rate would be around pre-pandemic levels. It would be a gradual tightening of the market, without the influence of the overnight rate.

Found a way to circumvent the stress test? This would have a fairly significant impact on the debt one can carry. Increasing the mortgage rate from 2% to 3% reduces maximum mortgage leverage by nearly 10%. As for existing homeowners, they would obviously experience no impact until renewal. Those subject to the stress test are unlikely to see a difference in their leverage. Unless rising rates push the stress test rate higher.

Improved Economic Conditions and Inflation Are Likely Cause

The end of quantitative ease (QE) and inflation, are contributors to this trend. QE drives the cost of bonds higher, lowering yields for investors. This has an intended spill-over effect, lowering mortgage rates. BoC announced they would begin tapering QE a few weeks ago. They are widely expected to stop it all together by the end of this year. The reduction (and end) to QE is a significant removal of downward pressure on mortgage rates.

Inflation expectations are also an important contributor — even if high levels are a passing phase. Last year, inflation was almost nil, allowing investors to accept low yields. Now that inflation is back, expectations for higher yields are returning. No investor is looking to receive a return smaller than inflation. With higher yields comes higher mortgage rates.

The expectation here is based on yields not rising until the Fall of next year. At the current pace of economic recovery, most see the Fall as the likely point when the BoC will hike rates. Some economists even think an earlier hike is more likely than a later one. If that were to happen, mortgages would climb even faster than this forecast. A scenario many would have thought unlikely less than a year ago.

Like this post? Like us on Facebook for the next one in your feed.

When it hits, it’s coming like a sack of bricks.

By far the worst part is going to be businesses could be using this cheap money for so many things, but everyone is a clown who keeps paying more for the same house, so we need to cut into earnings with higher inflation rates and higher interest rates.

Great. Make the houses even less affordable with higher payments.

There are only like ten people that know how interest rates work apparently, and you’re definitely not one of them.

Could’ve just said

Nya Nya Nya I know something U dont

The clowns who paid hundreds of thousands over asking shouldn’t blink over a rate hike. According to them, it a nothing burger.

Hey man. If everyone passed the stress test and no one committed mortgage fraud, it should be all good, right?

Some of them actually think Turdeau is a good leader!!! A Leader???!!! Amazing!!!!