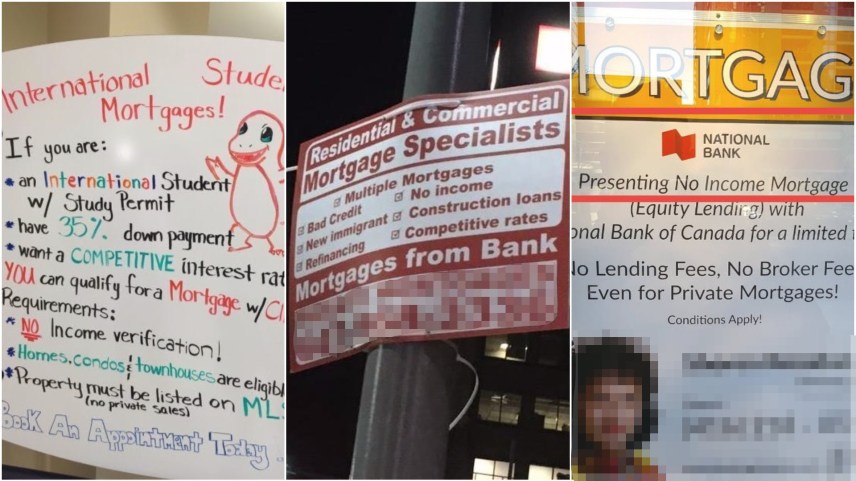

After years of doing mostly nothing, Canadian regulators are springing into action. The Office of the Superintendent of Financial Institutions (OSFI), after successfully rolling out B-20 Guidelines, are turning their focus to equity lending. Mortgages issued this way allow lenders to gloss over income, and rely mostly on equity in the home. 1 in 5 loans during the 2017 Spring buying season were issued this way, and OSFI wants to put an end to it.

Home Equity Lending

Home equity lending is the industry’s way of simplifying lending to people with wads of cash. Rather than relying on boring shit like your income, they rely on the amount of equity you have in the property. If you have substantial equity, usually 35% of the property’s value, you’re a pretty low risk to a bank. Instead of making you jump through hoops, they take your word on your income. Sometimes the income can even be very low compared to the size of mortgage being taken out. It sounds risky, but not as risky as you’d think for the lender. You would have to default on your home and see home prices fall enough to wipe out the total equity on your home. Not likely to happen, unless a large correction is in the cards.

Still unclear? Say you just moved to Vancouver, and the first thing you do is head over to the River Rock Casino. You leave with enough cash for a 35% downpayment on a house, so you go shopping. When getting a mortgage, they don’t need to do a “traditional” verification of your income. Tell em what you make wherever you’re from, they take your word, and boom! You’re a homeowner. Congrats! Canada has to be one of the very few countries in the world where proving what you make is considered a “burden” for many.

Who Needs Income When You’ve Got Equity?

Equity loans became really popular during the run up on real estate prices in Toronto and Vancouver. However, since B-20 rolled out, OSFI believes there might be a decline in the number of these deals being made. From April to July in 2017, 20% of loans had an amount greater than 4.5 times the borrower’s income. During the same period in 2018, that declined to 14%. We went from 1 in 5 deals relying on equity instead of income, to 1.4 in 10. It’s not perfect, but it’s an improvement.

Canadian Mortgages Larger Than 450% of Income

The percent of mortgages issued greater than 4.5 times the borrower’s income, from April to July 2017 vs the same period in 2018.

Source: OSFI, Better Dwelling.

OSFI To Discontinue Equity Lending

OSFI hopes to eliminate equity lending soon. In their industry newsletter, the regulator said they will be “taking steps to ensure this sort of equity lending ceases to exist.” They obviously mean cease to exist at organizations regulated by them. Equity lending is popular at private lenders, which operate beyond the reach of OSFI. Private lenders are soon to see this as a growth segment.

OSFI may seem like they may be coming down hard on potential homebuyers, but that’s not their mandate. The organization is responsible for ensuring sound operation of the institutions they oversee. The crackdowns aren’t to prevent you from buying a home, but to protect the banks. Before you rush out to get one of the last equity loans issued, remember that OSFI is worried you can’t pay these back. Worth thinking long and hard on whether you actually want one of the last ones issued.

Like this post? Like us on Facebook for the next one in your feed.

Photo and hilarious argument between a bank and a mortgage broker: Mr. Silbergleit

I really don’t see the risk with lending to someone with that much capital down. The risk is so small, it would almost never impact the market.

The risk is if someone overpays for a home, and the true value drops. If there’s a 35% gap between those two numbers, which it looks like there is with detached homes in some Toronto suburbs and Vancouver proper, the bank is sitting on a home without value and a borrower that couldn’t pay it in the first place. If I was that borrower, I’d probably say the hell with it and walk away.

You don’t see the risk of letting people that don’t have enough money to buy a house, buy in a bubble? If it helps, consider this: How did they accumulate a downpayment with an insufficient income to carry a mortgage? Sure, some people may have had a higher paying job, and are now making less. One in Five people? That’s truly a miracle that they could have saved that much. They must be first time buyers that are 50.

Thomas, It looks OK at first. But when you dig into it deeper you see that:

– Many of those downs are borrowed

– Homeowners refinance to higher LTV later

– They open 2nd and 3rd mortgages

– Tap into equity using HELOCs

So at the end that 65% loan often turns into 95% or even 100% LTV loan. And that’s of course is a huge issue not easily detected by regulators.

Borrower 1 takes 35% down using HELOC/LC from TD, opens a 65% LTV non-insured mortgage at RBC for investment condo.

Borrower 2 takes 35% down using HELOC/LC from RBC, opens a 65% LTV non-insured mortgage at TD for investment condo.

On paper everything looks perfectly safe but in reality it’s 100% LTV non-insured exposure for both of the major banks.

It’s the discrimination. I purchased a home for wel over $1M last year and put down 50%. It took 3 months to prove all the garbage the top 5 bank required. At month 2.5 I asked the broker if I was Chinese off the business class sleeping cabin on Air Canada from Beijing would this have been easier. He said it would have been a one week process. In fact, he has seen students buy more expensive homes much faster. Racist Canadians. You punish your own and help the rest of the world.

Amen it was a Herculean task for me to file all my documents to buy a $350 house outside the city with over 20% down. It was as if they couldn’t believe I had a job and they also couldn’t believe I actually saved up the money.

Interest rates are rising and Fast US is on over drive and Bank of Canada will have to follow, prices will come down, therefore the banks are scared! Look at Australia same formula !!!

FAKE NEWS is fueled by the real estate industry.

Now it all makes sense. If Toronto had a bunch of people that borrowed from their parents HELOC, then overextended on the payments, the number of mortgages being issued at prices last year would be more realistic.

There’s more than enough buyers that could afford at these prices in Toronto. The problem is they aren’t the ones buying, because they likely already owned.

The Bank of Mom and Dad aren’t OSFI regulated, so they’ve been providing significant leverage to get their kinds “on the property ladder.”

Mom, Dad and the kids used to love playing”Snakes and Ladders”….

Introducing the all new game “Property Snakes and Ladders!”

Now available in Canada.

Pushing the mom and dad narrative is certainly entertaining pushing the blame on Canadians, but foreign funds continue to hold prices through the use of foreign market power so that the trillions already dumped by Chinese will not devalue. Keep pushing your narrative. Eventually, someone willl believe it.

NINJAs be everywhere.

Hm… it would be a NINJA if the asset used as collateral is the asset they’re borrowing against, wouldn’t it be? That’s funny.

Bwahahahaha! That’s gotta be intentional that we didn’t “win” before leaving the casino? Just left and bought a house. lol.

I feel like I’m missing something?

Yes.

https://globalnews.ca/news/4149818/vancouver-cautionary-tale-money-laundering-drugs/

I think people owe BD an apology for calling this 2 years ago and people saying it was just a conspiracy theory.

https://betterdwelling.com/chinese-gangs-and-canadian-real-estate-the-odd-correlation/

Yes. Great article.

I know a single guy who spends 50% of his take home income on a car. Insane? Perhaps, but he makes all his payments and scheduled service appointments. First time around he put 50% down. Second time around 25% down. Third time around 20% down. Its all about trust, not about risk management analytics. Formulas are for people a company does not know personally.

The difference is the more cars get bought, the lower the prices. The more houses are bought like this, the higher the prices. Lenders have to increase the number of times they do this to the point where it’s 20% of the market.

Once that stops, the house that’s still being paid off goes back to normal prices. The resale value of the car doesn’t impact further financing. Houses renew every 5 years.

Love the River Rock reference.

I’m in Toronto and I still chuckled at that “subtle” reference..

I like BD, so please take this as constructive criticism: the “Canadian Mortgages Larger Than 450% Of Income” plot is terrible. First, there’s no need for a plot to illustrate 20% vs 14%. Second, there’s even less of a need to illustrate that with a visually misleading baseline at 13%.

Another one of those 0 axis people. lol

There was much discussion about this when I first started reading BD. In finance they don’t zero the axis, otherwise it’s difficult to tell what the fuck is going on over time. A stock like Amazon’s chart would look like a horizontal line over the past few years.

So you think it’s proper data visualization to have a 20% bar 7 times bigger than the 14% bar?!

I also like BD, but this is downright deceptive.

Let’s not downplay how big a six point delta is. It’s about twice as large as real estate prices typically rise, only Canadian don’t seem to understand that.

I agree with Someguy.

While the finance industry may not 0 the axis, showing a scale of 14 to 20 when you have only two data points and they are 14 and 20… it seems very inappropriate and misleading. The formatting would look significantly better if they started the axis at… 5? 10?

Otherwise I too love BD.

You think that plot makes it easier to tell what’s going on through time? *That’s* an appropriate way to illustrate 20% vs 14% between two years? C’mon man, that’s just silly.

Nowhere did I say that every axis must start at 0. I said that plot is terrible, and it is.

Looks like a mobile plot error. Read the article on desktop and the chart didn’t look ridiculous. Checked back for the comment area, and it’s ridiculous. 😂

Misleading or inept statistics representations, the writer must work for a political party too.

Can you Boomers go back to reading TV Guide and being hated by your kids?

Their charting software most likely does an auto-resizing, that’s “best for most” but not “best for all.” Try resizing the window and refreshing, it looks different at each breakpoint. I build data visualization projects for living, I know that correcting that “minor” looking issue would probably 8 hours of coding. But old people think websites cost $50 and kids can build apps in a weekend. 🙄

I’m really not sure how a crappy plot turned into an “old people” thing. It’s a crappy plot. It’s crappy under any resizing, on my desktop and phone. I’m pretty sure I would have thought that at 16. Too hard to fix? Then take it out. It’s 20 vs 14. Their relative magnitudes don’t need an explanation, and don’t need a plot. Would you happily show your boss or client this data visualization?

Round of applause for the only people that can explain upcoming regulation changes and throw a subtle joke about regulators not having a clue about what’s happing. River Rock, 🤣🤣🤣

what the article doesn’t mention is the delinquency rate on these loans is tiny, which is why banks love them. it has been pretty hard to get an equity loan for Canadians with any bank or even a credit union, but will be good to see the new immigrant program killed once and for all (BMO, CIBC). bring on the 20% correction!

That’s because most readers here are smart enough to know defaults are a lagging indicator. There’s literally dozens of articles here that covered default rates and lag.