Higher interest rates might force Canadian households to do the unexpected — pay down debt. That was one of the findings in the Bank of Canada (BoC) Survey of Consumer Expectations. The Q2 2022 results show many households plan to change spending behavior if rates rise. It also revealed the average person expects inflation to be at double the BoC forecast next year.

Households Inflation Expectations For Next Year Surged To A High

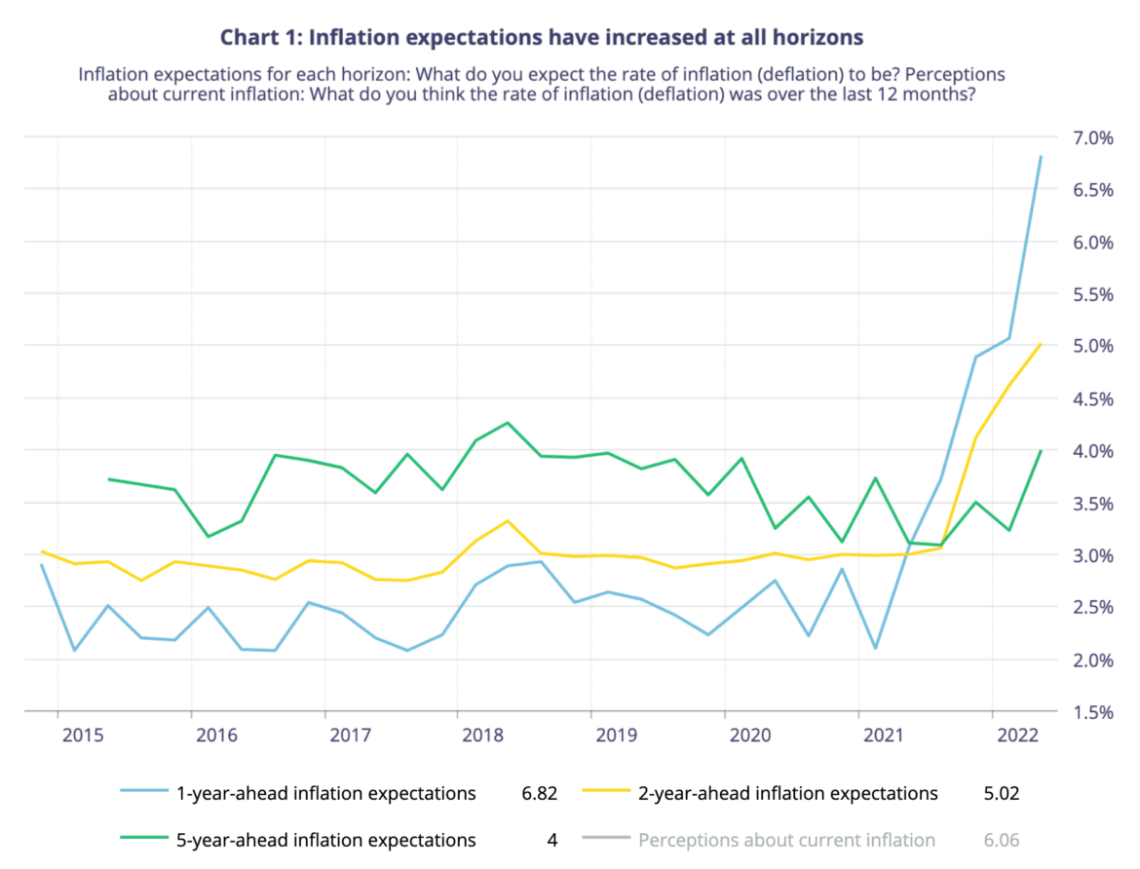

Canadian households are expecting inflation won’t be coming down much over the next year. Respondents expect annual growth of inflation will hit 6.8% by Q2 2022 over the next year. They also see annual growth at 5.0% two years from now, more than double the BoC’s target rate. Both responses received the highest annual expectations in the history of the survey.

Source: Bank of Canada.

Most Canadians Have Doubts About The BoC Controlling Inflation

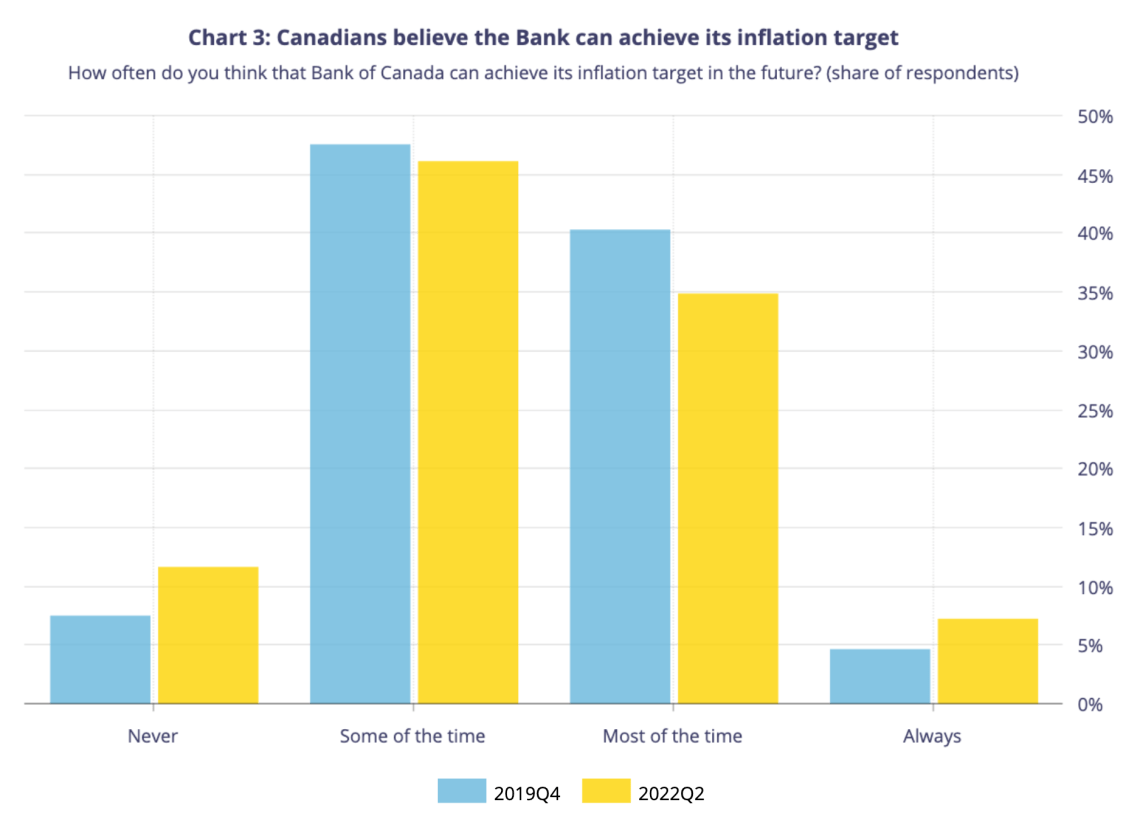

Many households shared doubts the central bank is able to control inflation. In Q2 2022, 11.7% of households felt the central bank can’t control inflation ever. Another 46% believe the BoC can control inflation sometimes. That’s 57.8% of households doubting the BoC’s ability to control inflation most of the time. It’s relatively flat from the 55% in Q4 2019, but that’s a lot of people doubting Canada’s monetary system can be effectively managed.

Fewer than half of households had confidence in the monetary system. Households felt the BoC was able to control inflation most of the time (34.9%). Even less felt the central bank was in control all of the time (7.3%). That’s 42.2% of households that believe the BoC is in control most of the time.

Source: Bank of Canada.

The majority don’t see the BoC able to control inflation most of the time, and a minority think it’s possible. What would your conclusion be? Wrong. Well, at least according to the BoC.

They took that data and came to this very carefully worded conclusion: “Most respondents indicated the Bank has the credibility and tools to bring inflation back to target.”

It’s an interesting way of viewing that data. Technically, it’s true. It’s hard to believe those who see the BoC sometimes controlling inflation are referencing right now. Perhaps in a more stable environment. No one collected the data on that, so it’s hard to draw a complete conclusion here.

Canadian Will Save More and Pay Down Debt If Rates Rise

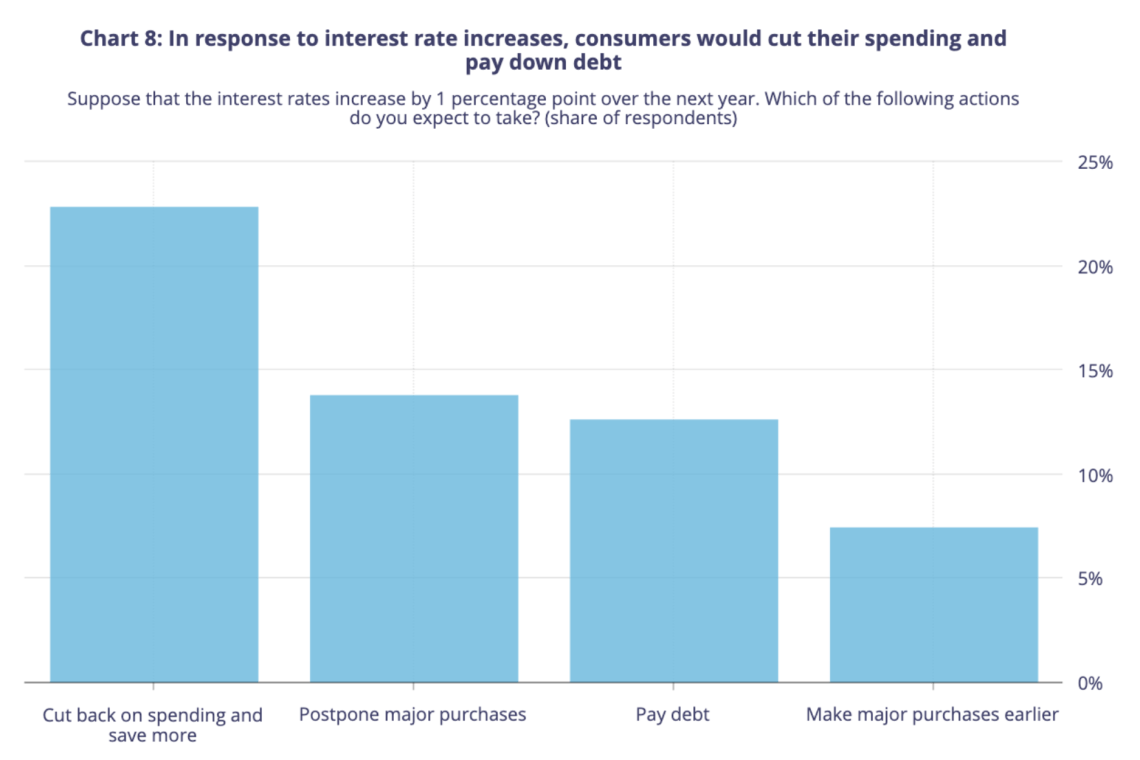

Higher inflation means higher interest rates, and changed spending behavior. If interest rates rise by 1 point over the next year, 1 in 5 (22.8%) of households said they’ll cut back and save more. Other households said they would postpone major purchases (13.8%) or pay down debt (12.6%). A small share said it would accelerate their purchases sooner (7.4%).

Source: Bank of Canada.

The last point is a bit odd, since higher rates slow inflation by reducing demand. In the age of panic hoarding, people paradoxically think prices won’t drop with demand. Instead, they believe prices will continue to rise even as fewer people purchase goods.

If interest rates go up most houses with mortgages will be shelling out an extra 500 to 1000 a month or more How will they pay down other types of debt ?

If you got a variable rate your costs is as high as a fixed rate. If you got a fixed rate, you’re not seeing any cost increase for 5 years, at which point your salary will have inflated enough to handle it without much event.

That is if you have a job.

The problem inflation is not caused by people. It is the companies taking advantage. Why does not anyone report the profits of the oil companies. If they are making 3 to 5 times their normal profits is it not them causing inflation and raising interest rates will have little effect.

Another way to look at the prime rate and even the Bank of Canada is not the most important thing in controlling inflation. It is simply the nerve of the gas companies as to what they can get away with. We use to look at prime now all we have to do is look at is the price of gas on any corner street. Rather then ride out the supply issues the bank is raising rates totally out of touch with the real problem.

Free Market baby – price gouging is nothing new in “free economies”. Government regulations/windfall taxes that get redirected into mass transit (urban landscapes) is a no-brainer. However, politics and lobbying have essentially killed this logical way of building a livable city. It’s landlords vs plebs all over again.

The uber-rich doesn’t care if the city falls apart, they have the war chest to rebuild and sell it at a profit no matter how long it rots. The housing systems are too tied to global financial markets as a piggy bank for the rich. Until there are regulations and decommodification of housing, this cycle will continue to ruin economies.

The thing about paying off debt is off as well. When people get scared they do not pay off debt but stop spending and stash away money. If anything they may think this is temporary and if unlucky and have a mortgage renewing soon will want extra savings. After all the banks usually do not defer mortgage payments. You want to make sure you have enough reserves and cash flow.