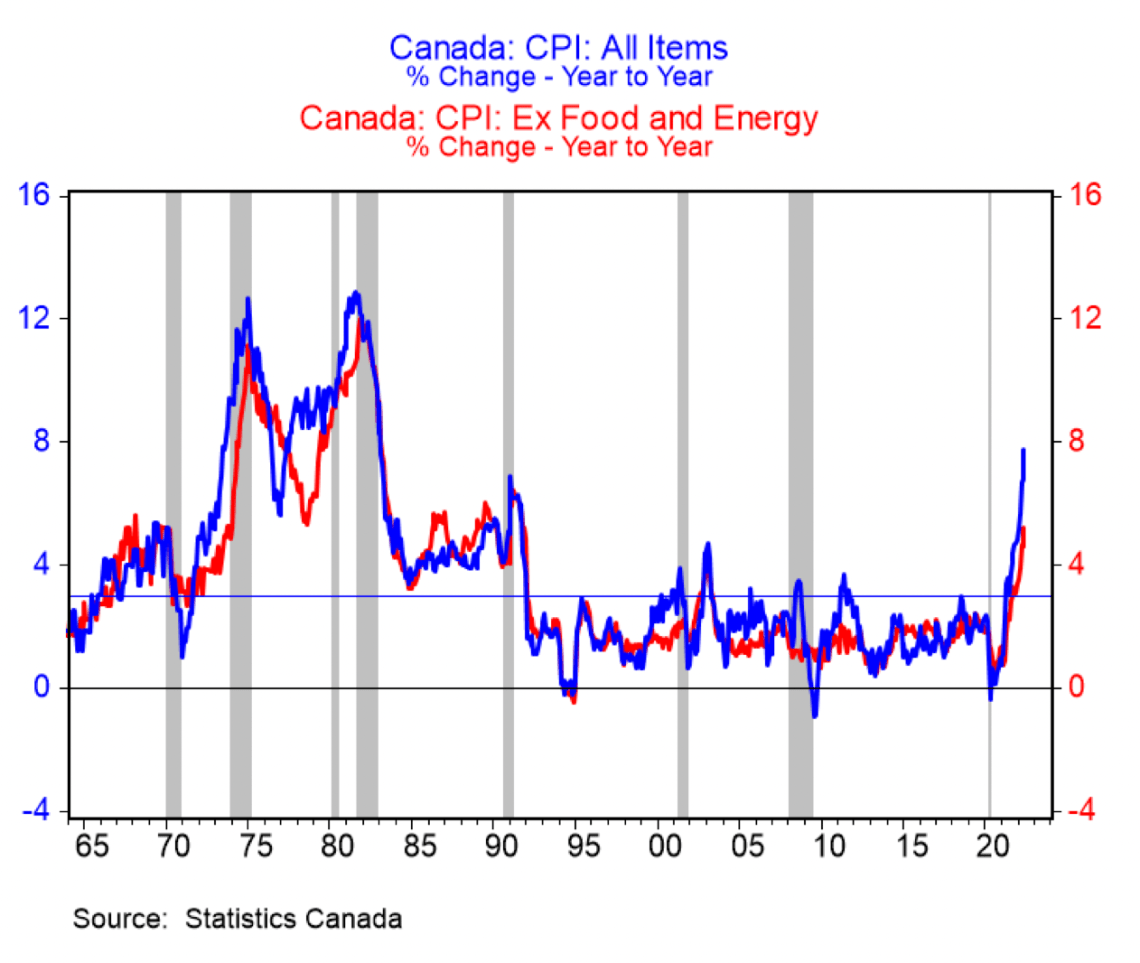

Canadian inflation continues to rocket higher as rate hikes occur at a snail’s pace. The Bank of Canada (BoC) policy rate still isn’t at the level seen at the start of 2020, but annual growth of the consumer price index (CPI) reached 7.7% in May, the highest level since 1983. However, BMO Capital Markets urges investors to consider whether the current level of inflation is actually cooling like in 1983. It may have more in common with its acceleration a decade earlier, resulting in the Great Inflation.

“The latest CPI blowout famously lifted Canada’s headline inflation rate to 7.7%, the highest since early 1983,” said Douglas Porter, BMO’s chief economist. “While that’s the typical comparison, inflation was on its way down (big-time) in 1983.”

He instead prefers to look at the last time inflation accelerated to these levels. That would be the Summer of 1973, when a hot economy and tight labor market pushed inflation to an uncomfortably high number. However, it didn’t stop there.

“Inflation then was launched into the stratosphere (i.e., double digits) by OPEC’s oil embargo late that year and by soaring grain prices. (Sound familiar?),” he said.

Core inflation, which strips out food & energy since no one needs those, came in lower than the headline inflation. Though it still remains elevated at 5.2%, more than double the desired target rate. Porter notes this is only the second time in the past 30 years where it’s shown annual growth above 3%.

He finds yet another parallel to the 70s. “Eerily, that too is very similar to the summer of 1973, when core CPI had picked up to 4.9% y/y. Do you suppose it boded poorly that the top grossing movie in 1973 was The Exorcist?”

It’s probably a fairly safe assumption that in the Summer of 1973, policymakers also felt they were close to peak inflation. No one saw it coming.

What about the interest rate now ?

I think I heard this from one of their videos, but the absolute level isn’t nearly as important as the speed of deviation from the norm.

By keeping rates low they let in much more debt, so a much smaller increase produces a much bigger hit.

Sounds like BOC are going to raise rates by 100 basis points this month. Which will do absolutely nothing to curb this runaway inflation. It’s going to be a bloodbath no matter which way you slice the cake.

The slower they hike rates the more likely the rate hikes get rolled into costs, which is the worst of both worlds. Exactly how the 70s bubble blew. Slow hikes all the way up the chain allowing it to adjust to each additional cost with more inflation.

Idiots in charge. Every one of them.

Seems like BOC is being too conservative with the interest rate hikes. (Also seems like they’re scared of a massive house price collapse.)

I don’t think they’re scared of a house price collapse so much as they wanted a house price boom to make people feel rich so they’d go out and spend.

How do you roll in the rate hikes into cost of a home? Higher mortgage rates rise, lower house values fall. Every single time. The slower the rate hikes, the longer the pain in real estate. Each 0.5-0.75% rise will shave 20% off. As the saying goes, asset prices take the stairs up and the elevator down.

Idiots are in charge. Agreed.

Just another “unknowable” consequence of massive market interference. Wasn’t Trudeau in charge the last time this happened?