The Canadian real estate correction has produced a glimmer of hope in young adults. In a worst case scenario, Desjardins sees home prices falling as much as 30% in a deep recession. It still won’t be enough to restore affordability—especially in Greater Toronto. The institution warns that housing is costing Ontario its edge, as its young adults flee to other provinces for more affordable digs.

Greater Toronto Home Prices Are Firmly Out of Reach For Most

Canada’s largest city, and its surrounding regions, are firmly out of reach now. The average price of a home across Greater Toronto reached $1.15 million in July 2023. That’s not in the City of Toronto, where it’s much higher. The Greater Toronto region is an expansive region including distant suburbs.

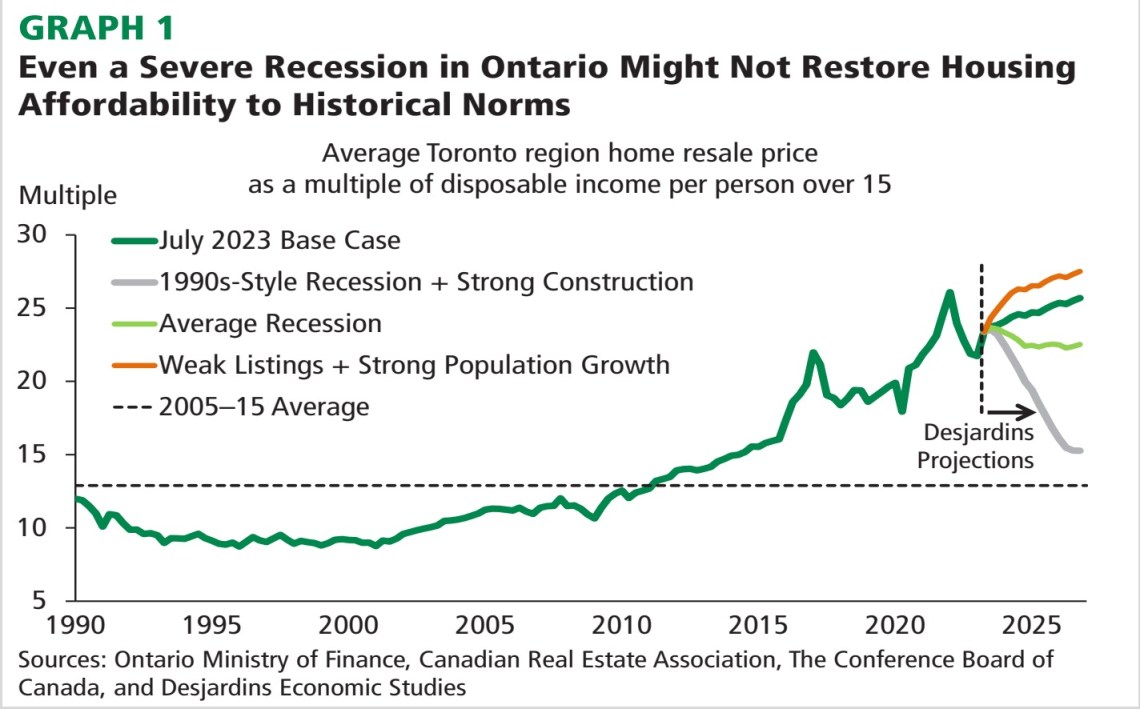

A base case is when things go exactly as planned, based on current conditions and forecasts. In this event, Desjardins’ sees home prices climbing another 9.3% higher to $1.26 million by the end of 2025. If wages fail to grow faster that would mean a further erosion of affordability.

Canadian Real Estate Affordability Needs A Recession To Improve

Recessions are less-than-ideal scenarios, but mean a purge of inefficiencies. One is expected in the coming months, even in the institution’s base case. “While our base case economic and Toronto housing market forecasts already assume there will be a recession in Ontario, it’s projected to be mild by historical standards,” says Jimmy Jean, chief economist at Desjardins.

In the event of a more serious recession, prices are expected to see a much deeper decline. An average recession means a larger hit to economic growth, driving prices lower. In this scenario, prices are forecast to fall 3.2% to an average of $1.12 million. Not even close to affordable, but it’s a start. Falling interest rates and rising wages can help even further.

Even A Large, 90s-Style Recession Won’t Make Greater Toronto Affordable

Any meaningful impact on affordability would require an “improbable,” 90s-style recession. In the 90s, a population boom still occurred, but home prices fell. They fell so much that it was peak affordability for a number of generations. Investors burnt by losses, and a poor job market prevented prices from re-inflating.

Of course, the rise of the internet left investors with more constructive places to put their money after. However, that’s another discussion for another day.

In this scenario, Desjardins’ sees the average Greater Toronto home price falling 29.6% to $0.81 million by Q4 2025. Accompanying the price decline, a recession of this magnitude would result in Ontario losing about 500,000 jobs. It might sound like a lot, but it’s significantly smaller than the losses due to AI, that former Bank of Canada (BoC) Governor Stephen Poloz warned are coming.

Even at that price, Jean doesn’t see affordability improving very much. “After years of being priced out of the market, many prospective Toronto homebuyers now sense an opening with a recession looming. But even in the direst of economic scenarios, we don’t see affordability returning to Canada’s largest city anytime soon,” he warns.

Adding, “…even if that improbable outcome were to materialize within the next three years, it would only bring Toronto’s home price‑to‑per capita disposable income ratio back to still‑stretched, late‑2015 levels.”

Young adults in Southern Ontario may not share his skepticism. Back in 2015, the share of income a median household would require to service a mortgage was 37.5% lower. It wasn’t exactly affordable, but it wasn’t impossible.

Greater Toronto Home Prices Could Still Climb

The financial institution didn’t give its upside scenario much air, but here it is anyway. If new listings fail to materialize and population growth remains strong, home prices could rip higher. In this scenario, they see home prices rising 1`4.8% to $1.32 million by Q4 2025. The bank uses this to emphasize the importance of keeping inventory flowing.

Though circling back to the early 90s, higher prices would also require incentive. Investors have been chasing lofty home price gains, becoming the majority buyer of new homes. This has helped to fuel even higher home prices, but higher interest rates destroy much of that incentive. If the cost of money is significant enough that rental yields fail to compete, home prices won’t necessarily rise.

Ontario Is Losing Its Edge As Young Adults Flee To Affordable Cities

The Desjardins’ analysis reveals Ontario is losing its edge. Jean points to his institutions’ previous look at the speed at which young adults are leaving Ontario. The trend is emphasized in the Greater Toronto area, as they seek more affordable accommodations.

“Thus, despite near‑record population growth, Ontario risks eventually losing the entrepreneurship and economic dynamism that young people bring,” warns Jean.

While the picture is bleak, it doesn’t have to be catastrophic. They believe the takeaway is the importance of continuing to boost housing supply. Restoring affordability is a long process, and that was already clear, according to the institution.

A fair assessment, considering affordability didn’t erode overnight. It occurred over nearly a year of negligence and stimulus. The market just went into hyperdrive when a record amount of stimulus was injected in 2020, and policymakers saw housing as the pillar to hold the economy higher.

However, the damage may be done. Even young adults with substantial incomes have struggled with housing affordability in Ontario—especially in Greater Toronto. After struggling for a decade with an affordable housing carrot dangled in front of them, they’re being told it’ll just be a few more years until they get it. With the oldest Millennials now over 40, they would have to be masochists to hold out for a best case scenario where they land their first home close to 50—with a mortgage term that goes well past retirement.

It looks like they fail to realize that bubble of such historic proportions might get deflated with historically large deflation. It might be well over 50%. Who knows.

Other than that the only way housing is going to be affordable again is massive vonstruction backed and planned by government. Good luck with that. Then the only other option is to leave.

Realistically, Millennials waiting for affordability to return are just trying to convince themselves they didn’t waste a decade of their lives. Like degenerate gamblers, they’ll chase bad money with good money, hoping it fixes itself.

Exactly, it’s Millenials fault that housing is 8x as expensive (inflation adjusted) than it was in the 80s.

They need to pull themselves up by their bootstraps and stop eating so much avocado toast.

dangling a carrot infront of Millennials is the most apt way I’ve seen it put. Maybe pump in another 10 years of tax dollars and premium rents and you’ll get to own your very own bachelor apartment!

I’ll admit, I pretended things will get fixed for way too long before finally pulling the trigger and moving to Calgary. Best decision I’ve made, since the wages are higher, there’s more savings, and people here aren’t as angry about their situation. People [gasp] actually like living here!

Investor in me is relieved by the fact that Ontario’s young adults won’t even vote, nevermind figure out the logistics of moving. Hahaha.

Living in their parents place is the dream. A harder working immigrant that arrives will eventually be their landlord.

You are very much the problem Otto.

Sure he is. Parasite. This is what such “investors” are. A lot of investors and troubles are piling up? How come? Where is the market and investors magic wand?

Nope, The immigrant will know Math and the law and buy only 1 house for themselves. Who wants the stress of a tenant who can stop paying rent for any reason and stay there legally for up to a year.

An important issue that many aren’t discussing is productivity in the face of no reward for people in Ontario. If they work hard, and get into the top 10% of incomes—the reward is they get to pay rent. They won’t be able to afford a mortgage on even a modest home, which any idiot in previous generations could.

Flooding the world with cheap loans effectively was the end of progress in the West, people just have yet to realize it.

You’re exactly right – this unbelievably massive debt bubble in Canada will eventually devastate our economy for a generation, but smart people aren’t going to keep renting while they wait around for that to happen, and the job losses that will result – they’ll leave Canada entirely.

Why again are we all staying in this stupid corrupt overpriced country?

I have my 5 year plan to move somewhere affordable…

Good question

Lower rates to 0% to pump housing and save this economy. Canada IS a global housing superpower.

This is Canada’s time to lead.

Pump up that bubble.

lollllllllllllllllllllllllllll

Its over Johnny!

Trudeau may not be the smartest knife in the drawer, but he and his advisors are fully aware that he has presided over the creation of one of the world’s largest housing bubbles, and now he is doing his utmost to make sure that it does not burst under his watch.

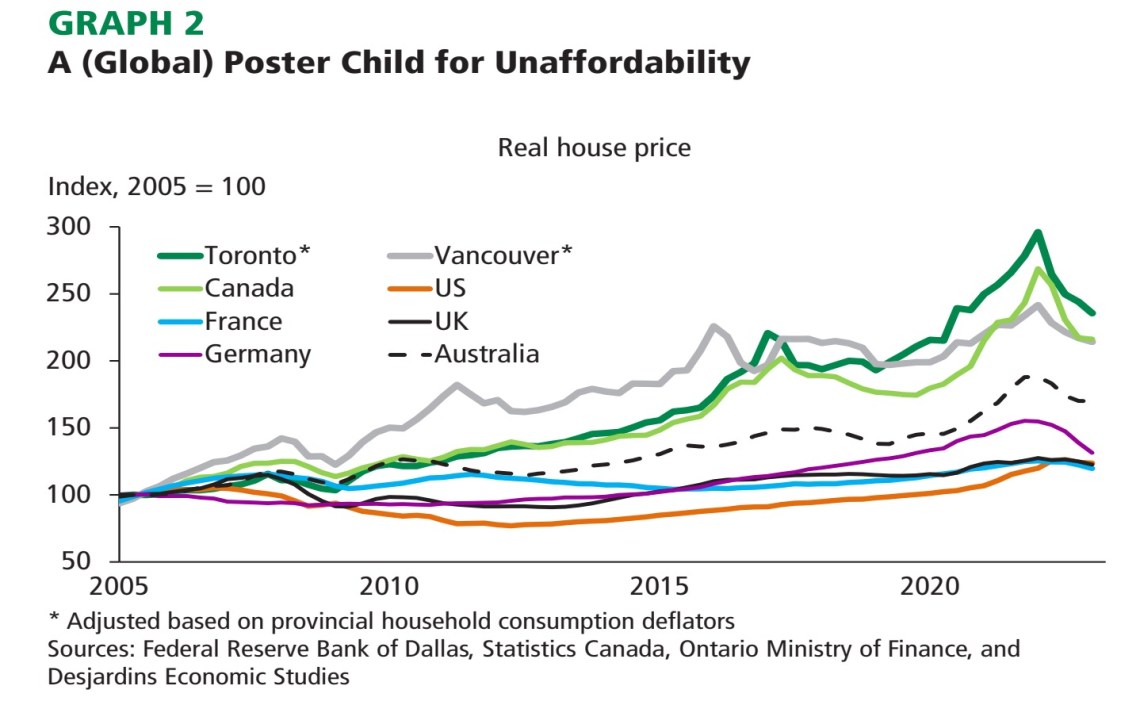

As Graph 1 in the above article shows, despite a recession, despite increased interest rates, and despite anything else, continued strong population growth will continue to ensure that the price of housing continues to increase.

That is why Trudeau is bringing in over a million new people a year, that’s how he keeps the bubble growing, rather than exploding.

Nothing else makes sense, our health care is falling apart as demand exceeds supply, schools are falling apart as student enrollment exceeds supply, and housing, especially the rental market, is driving people into the poor house as demand exceeds supply.

I say focus on self_improvement and buck the trend that predicts your future! Speak to pros who can help u with a blueprint for homeownership(s)!… in ANY economic environment!

People who listened to the warning by experts and media about impending real estate crash / correction back in 2012 (refer to Toronto Star articles at that time) are still renting apartment, while people who ignored such “advice” and bought a house in GTA around the same time are enjoying over half a million dollars in built-up equity.

If you keep on predicting real estate crash, eventually, after indeterminate number of years, you’ll get it right. However, you miss out substantial amount of equity appreciation meanwhile.

Who was warning in 2012, when inflation-adjusted home prices in Toronto just recovered its 1989 high? Today is different though, not because of home prices—but Canada doesn’t offer any growth opportunity for anyone with even a low level of in-demand skills.

When I arrived in Canada, I could at least become a tradesperson and do quite well. Hard work, but at least you could see the things you’re getting. Today a tradesperson might be well paid, but that pay still isn’t enough to live in most cities.

The solution to the affordability crisis is so simple it’s stupid. Governments at all levels, municipal, provincial and federal, just talk, talk, talk. There just isn’t the political will to do what is necessary. Get rid of the ALR, release land from crown. Sell 150k acres of crown land at $100k per 1/4 acre lot. That would make over half a million lots available for sale. Make them available only to those who do not currently own. Allow them to build modulars or conventional stick frame homes. And if you think 150k acres is a lot of crown land… its not. It’s a drop in the bucket. However, this would mean that 1.5 million dollar BC box in Burnaby, would plummet to around $400k. Joe voter that owns that house would be furious. Not to mention, all the cronies of government who are heavily invested in real estate who would see their investments go back to “real” values. Nah, just wishful thinking. Never gonna happen. I just get tired of politicians and media talking like this situation is soooo complicated. Repeating the rhetoric “there just isn’t enough land”. Yeah, ok.

I am 67 years old and have seen three major housing market crashes in my lifetime. The one in 1992 caused me to lose 45% of my house value in 12 months. Due to a marriage breakup I was forced to sell and take the hit. Looks like I’ll be watching a 4th market crash. Yes my friends, they actually do have been even though you think it’ll never happen to you.

I agree with the fact that we are all hoping that things will get better in Canada, reality is will not.

Conclusion, who wants to live if this is life in an extremely cold, overpriced country.

Young people will move somewhere else and have at least a relieve from this non sense mortgage payments.

Unfortunately Canada will let go a lit of capable, professional people.

This crisis is men made. Highly educated youth are struggling for jobs, new immigrants below mertis arrive, fake demands supply chains, issues, then inflation, then rates hikes, then high groceries, less housings, someone is doing it.

Very unfortunate that we have to see all this.

Majority of us migrated to Canada with high hopes to live a respectful life; world class medical facilities, education for kids, a nice job in your own trade, and very own roof on our heads: wrong federal and provincial policies have stripped us from all these dreams: crime is increasing, young ones are not getting deserving jobs, people start defaulting on mortgages, health system is in tatters:

Thank you Mr. Trudeau- you have manifolded your net worth from $5M in the meantime, at the cost of throwing the country in deep economic ditch. You haven’t made any effort to make this great country self sufficient in ANY way . Ford is also rowing the same boat…CORRUPTION prevails at all levels👏👏👏

Good luck Canada😔

Here is a possible strategy that may help SOME younger people nudge themselves into affordability.

1. Cut down on the ridiculous amount of tattooing. I’ve seen enough artwork on some bodies that could provide a down payment. I exaggerate a little.

2. Cut down on Starbucks. It adds up.

3. Cut down on the 14 dollar cocktails and general bar fare. No shortage of unaffordable housing victims at nightclubs there.

4. Etc etc etc

Look up the word sacrifice and see if maybe this is something could help your problem. Waiting for government can be a long process

Time will pass, things will change, and you either adapt or don’t. Just like the cave man. Except we have rav4s and iphones.

We always have a good laugh at what the fast talking immigrant builders get away with in Canada. A 2M dollar shit box on a 50 foot wide lot is a rip off.

Go see what 2M buys in the USA. You will never buy in Canada again.

$2 million home would also get you into some of the nicer neighborhoods in the US, since home values aren’t a ponzi system to replace the poor labor opportunity like in Canada.

At 72 years of age I have heard these exact same comments about the affordability of housing in Toronto and the GTA for 40 years. This is not a new issue.

At 72 I imagine my math skills will be a little soft too. Most people that aren’t professional investors don’t understand that the price of everything always rises, opportunity cost determines return.

In this case, Canada’s talent that can afford to live here should be asking itself if they should see a third of their hard work go to a Boomer just because they were born first, or should they move to an economy where that extra money can buy a higher quality of life, security, and help their career.