Canada’s real estate industry wanted weaker stress testing, but it may have been too weak. That’s the take from BMO Capital Markets, who recently crunched the numbers. As interest rates climb, the majority of borrowers will be able to easily manage higher costs. However, recent buyers are facing rates even higher than they had been tested against.

Canada’s Mortgage Rollercoaster Insufficiently Prepared Recent Buyers

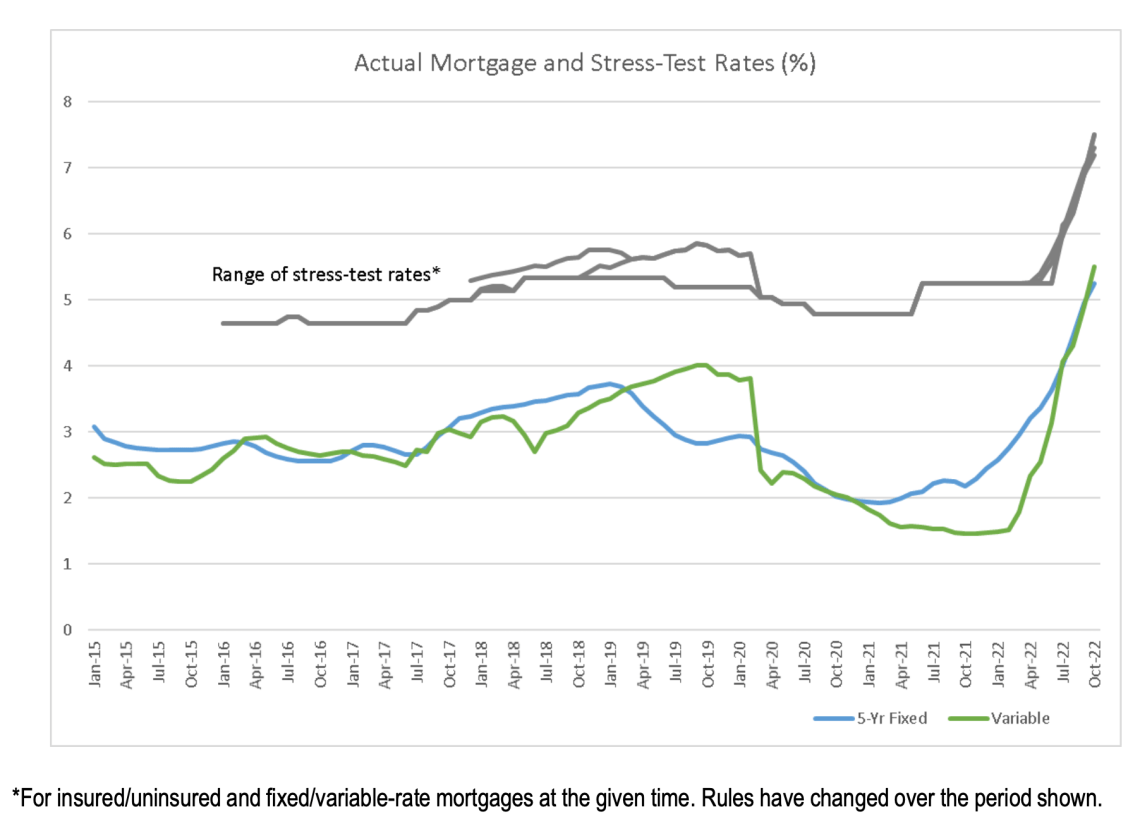

Canada began stress testing mortgage borrowers around 2016, preparing borrowers for higher rates. In its current iteration, the test ensures payments can be made on the contract plus 2 points, or a minimum floor — whichever is higher. This lowers leverage and gives a buffer for borrowers to prepare for any sudden shock. So far, it’s helped to mitigate forced selling or defaults. However, it may not have been enough for this environment. not have been high enough.

Mortgage rates over the past 5 years have been on rollercoaster over the past few years. They hit a record low, falling in the mid-one point range, surging above 5% currently. For many, that means they weren’t prepared for the recent variable rate or renewal surge.

Canada’s Pandemic-Boom Buyers Are Especially Vulnerable

Canada’s recent boom-time borrowers are most at risk, BMO warned investors. Mortgages were being taken out with a 2.0% interest rate, with a stress test as low as 4.75%. Those borrowers wouldn’t have been tested against today’s rates. Variable-rate mortgage debt also became the most popular during this period, meaning untested borrowers are currently out there.

“…those who took variable rates at the height of the boom in 2021 qualified at 4.75%-5.25%, depending on the timing,” explained Robert Kavic, a senior economist at the bank.

Adding, “… their underlying rate has now pushed above that mark even if fixed-payment features are masking the blow for now.”

It doesn’t mean these borrowers will instantly default, since lenders work to prevent foreclosure. Extending amortization and refinancing are both popular tools for those renewing. There are options — they just might be less than ideal.

Canadian Mortgage Rates — Actual and Stress Test

Source: BMO Capital Markets.

Canada’s Longer-Term Mortgage Borrowers Have A Sufficient Buffer

Mortgage borrowers that are coming up on a five-year renewal are much better off. “Five years ago, borrowers taking 5-year fixed mortgage rates would have qualified around 5%—many will be renewing into higher rates,” said Kavcic.

He doesn’t see this as a significant risk, though. Over the past five years, wages advanced and mortgages were much smaller. This can allow households to more comfortably adapt to the change in market. That’s before embracing any default mitigation tools from lenders.

BMO doesn’t see either segment of borrower in hot water at this point, but that can change if rates rise. “Stress tests should provide insulation from the rate hikes we’ve seen so far, but there’s very little buffer left,” he said.

Higher interest rates than where we currently face? We might have heard a lot about the “peak” of inflation, but that might not be the case. In our latest interview, former Bank of Canada governor Stephen Poloz discusses fiscal prudence playing a role in future interest rates. If Canada’s fiscal stimulus proves to be excessive, the central bank may need higher rates to curb inflation. Your move, provincial and federal governments.