The US is raising interest rates for the first time in years, and they plan to make up for lost time. The Federal Open Market Committee (FOMC), which governs the US Federal Reserve, announced a quarter-point hike today. This increases the federal funds rate lower (0.25%) and upper (0.50%) bounds for the first time since 2018. Rates are still near historic lows, but the FOMC indicated they see another six rate hikes this year. The central bank is sending a clear message to consumers — the free money party is over.

US Federal Reserve Expects 6 Rate Hikes In 2022

The hike was expected, but the number of future hikes the committee signaled was a surprise. FOMC participants expect the federal funds rate to hit 1.75% by the end of 2022. If that were to happen, the market would need another six rate hikes. Some forecasts saw this occurring over a much longer time span, but not anymore.

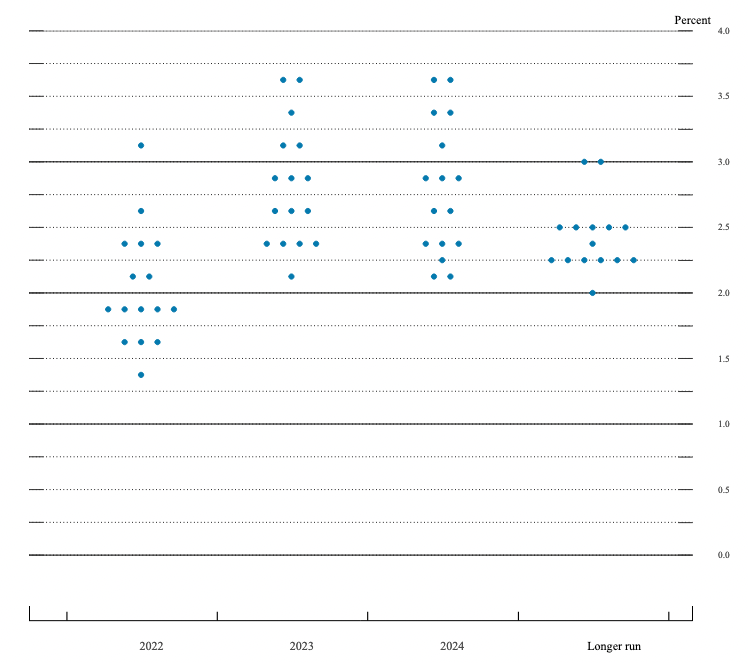

FOMC “Dot Plot” of Rate Expectations

The FOMC participants’ forecast for where interest rates will be each year.

Source: FOMC.

Reserve Bank of St. Louis president Bullard reiterated his call for a “super hike.” These are non-standard rate hikes of 0.5 points, about double the usual move. He’s been warning of a housing bubble resulting from lax policy for about a year now.

US Federal Reserve Expects A Lot More Inflation

The big reason for the aggressive rate hike schedule is to try and tame rising inflation. US inflation hit a 40-year high in February, which doesn’t factor in much of the global conflict. Their forecast for core inflation is now 4.1% annual growth for 2022, up from 2.7% in their December forecast. Central bank inflation forecasts have creeped higher in Canada recently, as the word transitory disappears.

The US Federal Reserve might appear aggressive, but they’re fighting for their credibility. Elevated inflation (and whether it was transitory) has been a controversial issue. They only recently began to acknowledge they were hit with an inflation shock. Before they even had the chance to raise rates, they were hit with the European conflict shock. Now with a shock on top of a shock, they’re probably wishing they acted more quickly.

The pricking of the bubbles begins!

2.5% long term seems low though no?

They should do what Canada does. Not think about the economy. It’s a blissful Utopia here. If we need more money, we just make it. That’s why we’re planting 2 billion trees. Ooops money is made from plastic. Plastic is made from oil. Return all your money to the banks and they will give us a battery…