Canada’s uneventful, but huge debt and frothy shelter costs, may finally come home to roost. Credit rating-giant Transunion released the results of its Q3 2023 Consumer Pulse Survey. Amongst the insights was the share of households expecting to consume more, revealing how a country stacks up to its peers. When it comes to households spending more, Canada ranked dead last in most categories. This may mark the end of the spending boom, as households tighten budgets at a rate higher than our global peers.

Retail Spending Intentions & Global Context

Consumption data provides important insights for household sentiment and prosperity. Households spend more when they’re doing well, and confident in the economy’s future. They stop spending when they’re worried about their future, or experiencing shock. That’s bad news.

A wise person once said, one person’s spending is another person’s income. Households spending money means more potential revenue for suppliers and workers. That translates into higher wages, more jobs, and generally more opportunity. A contraction does the opposite—less money, lower wages, fewer jobs, less opportunity.

Today we’re looking at planned consumption over the next three months. In general, a greater share of households planning to spend more is better. Smaller shares mean more households have economic concerns, and plan to pull back. While spending less and saving might be good planning for households, reduced spending amplifies downturns in the broader economy.

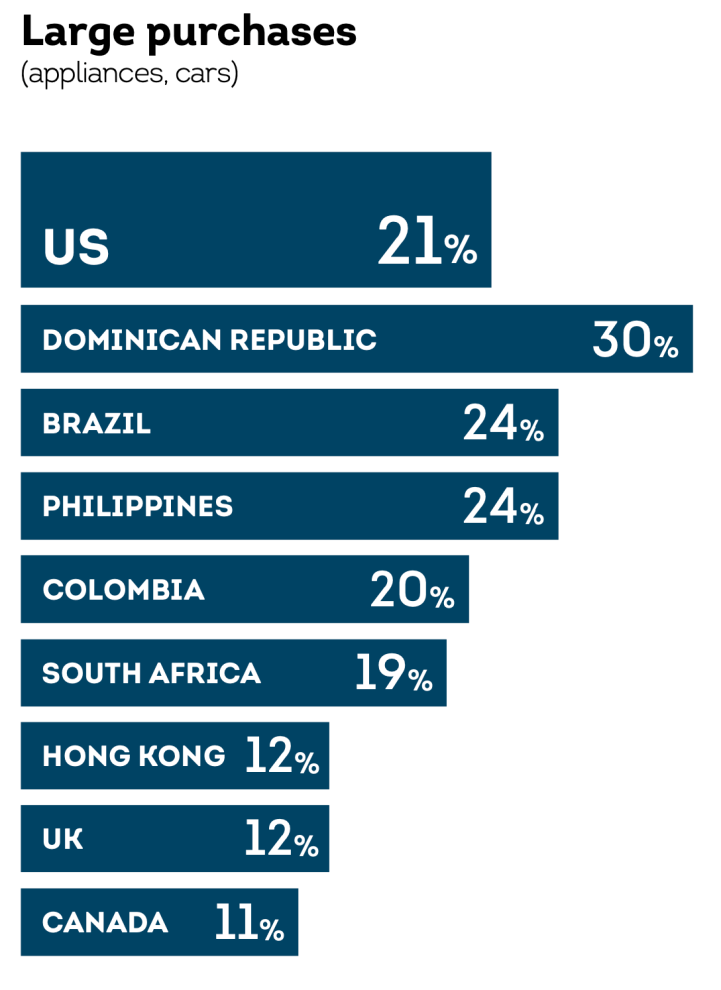

Canadian Households Are Pulling Back On Cars & Appliances More Than Other Countries

First up, large purchases like appliances and cars. These are often called “hardgoods,” and lead the business cycle. Just 11% of Canadians plan to spend more in this area, making it dead last in the countries surveyed. In contrast, US households plan to spend nearly double (21%) more.

Source: Transunion

Topping the list were younger, developing economies. Rounding out the top three are the Dominican Republic (30%), Brazil (24%), and the Philippines (24%). One of those countries is a major source of Canadian immigration. That may end the population boom, since people don’t usually leave more confident economies.

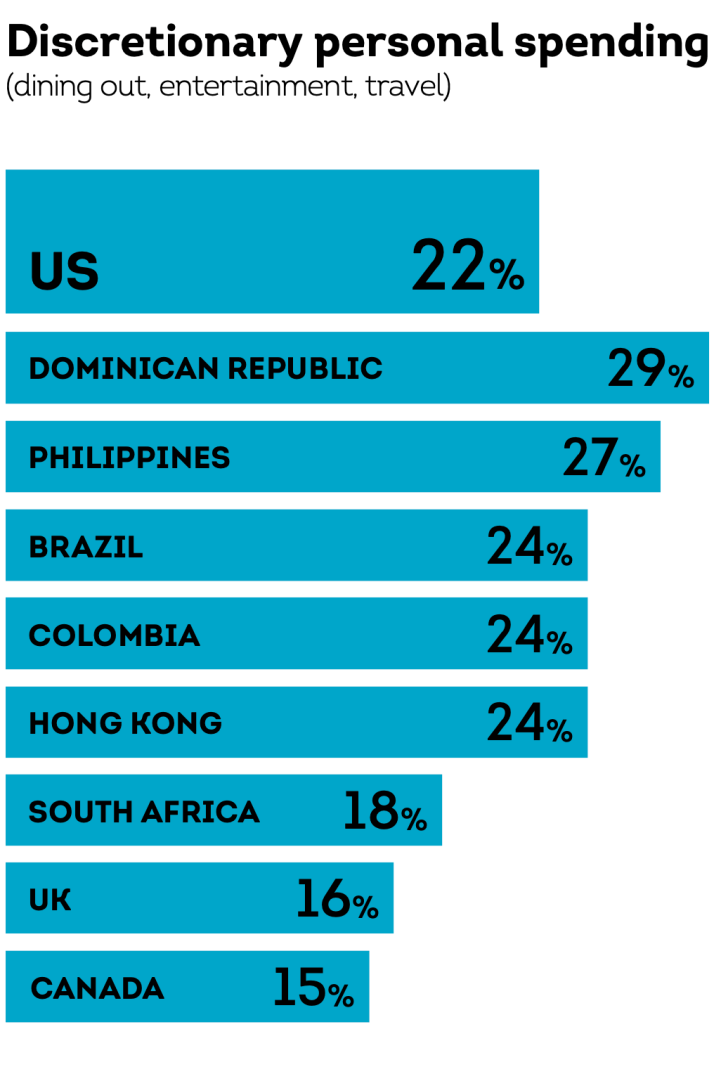

Debt Heavy Canadians Don’t Plan To Do Much Discretionary Spending

Discretionary personal spending is another extremely important area, largely service-related. Shifts in this area have a big impact on labor, since it’s consumer-facing. Just 15% of Canadians plan to spend more in this area, the smallest share on the list. Not having any extra money to spend on discretionary services can lead to a big loss of jobs for the segment.

Source: Transunion

Intentions in the US are considerably higher, with 22% of Americans planning to spend more. However, the list was once again topped by the Dominican Republic (29%), Philippines (27%), and Brazil (24%).

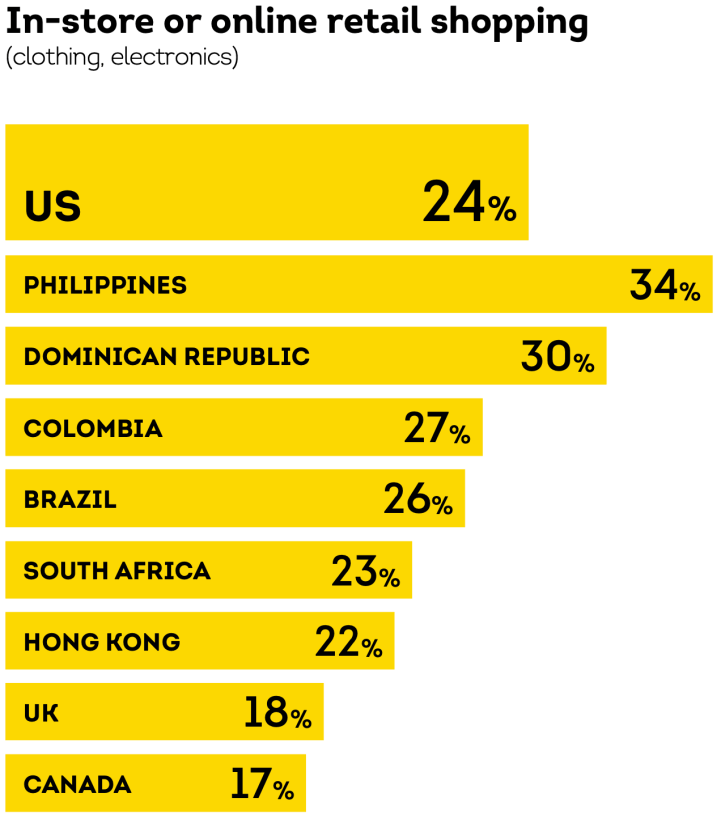

Do You Even Christmas, Bruh? Canadians Plan To Trim The Retail Fat

Canada also lagged when it comes to retail shopping, either online or in-store. Only 17% of households planned to spend more in the next three months, putting Canada in last place again. The US was somewhere in the middle with 24% of households planning to spend more. Where the heck did everyone’s pre-game Christmas spirit go?

Our now usual suspects lead when it comes to retail spending intentions. The Philippines (34%) tops the list, followed by Columbia (27%), and Brazil (26%).

Source: Transunion

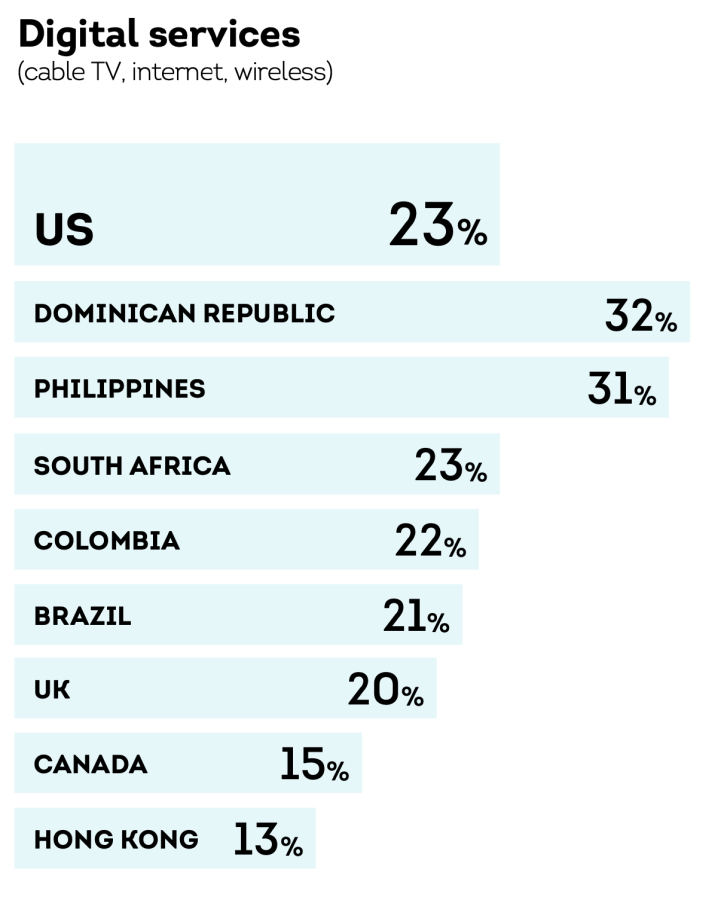

Spending More On Wireless Is Still As Canadian As Maple Syrup & Money Laundering

Digital services include cable TV, internet, and wireless. The survey reveals 15% of Canadians plan to spend more in this area. In contrast, the US showed 23% of households plan to spend on digital services in the next few months. The list was topped by the Dominican Republic (32%), Philippines (31%), and South Africa (23%). Only Hong Kong (13%) had a smaller share of households than Canada. Canadians are more confident they’ll spend more on wireless service? That’s a shocker.

Source: Transunion

Canada doesn’t have the same level of consumer confidence as its economic peers. That will be a limiting factor for already slowing economic growth, which not even the population boom is helping. It’s bad news, but not entirely surprising with shelter costs and debt loads. Especially when put in context with the rest of the world.

Earlier this month Canada’s largest bank issued a similar warning due to shelter and debt. RBC research revealed that young Canadian adults face much worse conditions than previous generations. In terms of wealth, older households more than made up for the hit young adults took. The net impact is very different though, since younger households drive spending. Ultimately this will result in slowing economic growth—an issue reflected in OECD data.

At the same time, the data reveals more robust intentions in developing countries. Developing countries with younger populations, and more robust economic growth. These countries are usually large sources of immigration that have fueled Canada’s growth. That presents a new problem for Canada’s policymakers: how long can the economy attract talent from places with more robust economic opportunities?

This reminds me of a housing panel I attended, and a Boomer on the panel interrupted Punwasi to say it’s not a problem that Millennials spend more on housing, because they were wasting their money going out.

Punwasi’s response was still the hardest I’ve ever laughed. Something like: “I know every Boomer becomes an anti-material buddist when they need to explain how Millennials can pay more for an asset they bought for a nickel, but the reality is people work at those places they spend money.”

People forget we can’t be the people that build, sell, and finance housing. I like living next to nice restaurants and shopping.

People talk about reducing spending to focus on housing like they expect the whole economy to just be grocery stores, banks, and real estate agents.

it is the time to leave this 3d world country.

You can leave. The reality is you’re still here for the same reason other people are uprooting their whole life—you like it more than anywhere else, and find it too scary to move anywhere else.

Buy a house, you’ll be fine after you get used to making the payments.

Hi Frank,

Thanks for the offer!

I intend to leave asap with my 2 kids (because in Canada you can’t call a girl a girl, because the state says so)

Along the way I’ll also be closing my business and therefore no more of those jobs and tax money.

If you wish to send a few Canadians my way to expedite the process, that would be most welcome!

We’re in a huge real estate bubble. It’s about to pop. Cope.

Totally agree, Kate. There are so many better places to live than Canada, with lower cost of living and better opportunities. Although I’m a 3rd generation Canadian, I’m not afraid to leave, and in fact I’ve lived in four other countries as well.

Now planning to leave again in a few years when my younger one finishes high school; in the meantime I’m helping to care for my elderly parents and spending time with them while I still can.

House prices are fine, wages need to rise so people can afford to support this economy.

That’s right. We need to support housing, and the wage-price spiral.

So we will be fine buying a house at current prices and just need to “get used to making the payments” with low wages. Sounds like a plan.

Employers are lowballing on wages. Labor cost is something that many employers are not glad to pay more for, unless one is a useless C-suite exec spending all day laughing with other rich people on ZOOM.

What an idiotic comment

Price to rent /income in the stratosphere never been so high.

Interest rates are still at historical lows and not going down.

Mortgage redemptions at 2-3 x

Ticking time bomb.

Yes P:R and P:I have never been this high before,and I’d like to think you’re right that it’ll all blow up one day, but I’ve thought that for a long time. Unfortunately, the corrupt, captured govt and BOC never fail to bail out overindebted idiots like Frank, no matter what, so while interest rates are still historically low, it’s only a matter of time until the whining of the desperate homeowers gets the interest rates lowered again, damn the consequences. Can you say moral hazard?

Why are perfectly valid comments deleted from this blog? The usual Canadian censorship?

This country isn’t serious, excluded from military pact, broken planes, woke and dumb. Own it

These so-called “frothy” Canadian housing costs have utterly ruined the country. Get out of Canada while you still can.

Telecomms would be far cheaper if we allowed American competitors in Canada to compete with our billionaire oligarchs like the Rogers and Shaws whom are bleeding ever nickel out of every canadian.

Note to new Canadians. Do NOT vote for Liberal or NDP governments.