Canada’s economy may be just a few short months away from recession. The latest gross domestic product (GDP) data from Statistics Canada (Stat Can) stalled in Q2 2023. As much of a red flag as that is, it gets worse when you consider the population boom. Despite there being a lot more people, households are spending less, especially when it comes to new housing.

Canada’s Economic Output Is Stalling

Canada’s economy is slowing down, but hasn’t quite contracted. The seasonally adjusted GDP for Q2 2023 was virtually unchanged, after rising 0.6% in the previous quarter. Compared to last year, economic output has only climbed 1.1%—less than its population increase.

Concerning by itself, but even worse—this trend is driven by a weakness in households. Uh oh.

Canada’s GDP Was Boosted By Housing, Now Housing Is The Drag

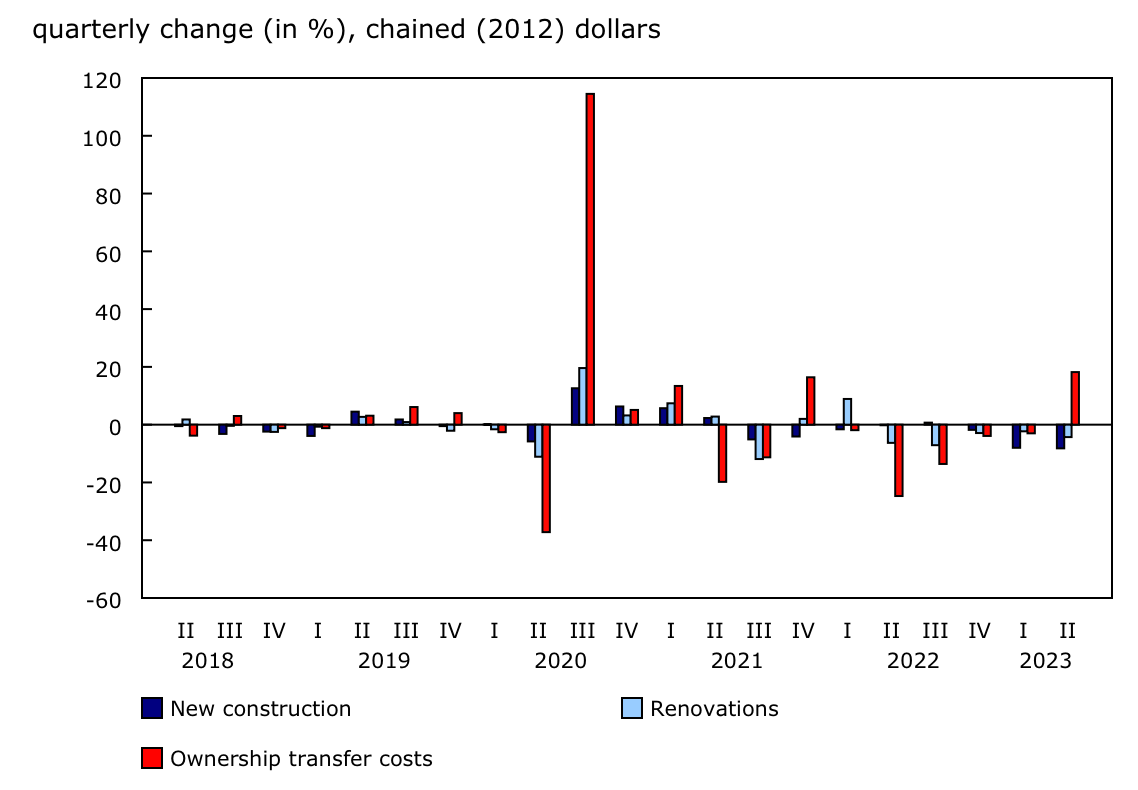

Canadian housing provided one of the biggest drags on GDP. Housing investment fell 2.1% in Q2 2023, marking the fifth consecutive quarterly decline. The drop was driven by slowing construction of new housing (-8.2%), with only Nova Scotia seeing an increase. Further slowing the economy was a taper in renovation spending (-4.3%). \

Canadian Housing Investment Is Pulling Back

Source: Statistics Canada.

After one of the biggest booms ever, it’s not surprising to see a housing slowdown. The bigger concern is that this is just a part of a more broad trend of weaker households.

Canadian Households Are Showing Signs of Weakness

Real household spending fell 0.1%, following modest gains in the previous quarter. It was driven by a drop in new passenger vehicles (-9.5%), furniture (-3.3%), outdoor recreation (-8.3%), and natural gas (-6.4%). A slight increase in spending on goods (+0.1%) softened the blow, but not by much.

A mild slowdown after a boom can be expected, but there’s a detail most are missing—the population boom. Since GDP is measured in aggregate, adding more people should in theory provide a boost to the country’s output. At the very least, if everyone’s stagnating on their output, any workers added to the economy should provide that little boost to push things higher. With Canada’s record population boom, it should be an incredibly easy task, right?

That’s how bad things are—even with the population boom, the economy is slowing. Population growth is padding just how bad things are for households. When adjusted per capita, household spending dropped 0.7% in Q2—the third quarter to contract over the past four quarters. A solid example of diminishing returns.

Canada might not see a recession at this point, technically. However, it wouldn’t be surprising if households felt like they were already knee deep in a recession.

Drop the interest rate to 0% to save the economy and pump house prices higher.

This is Canada’s time to lead. Go Canada Go!

#canadastime

We may not know the definite solution to this. But we’re pretty sure the solution is not more of Trudeau.

Drop interest rates to 0% to pump housing and save the economy.