Canadian real estate affordability data paints a dreary future for young adults. BMO’s latest look at affordability reveals it hasn’t been this hard to buy a home since the late-80s bubble. The brief period of rising interest rates didn’t help, but there’s a bigger issue. Interest rates are the highest since 2001, but since then home prices grew 3x faster than incomes.

Canadian Real Estate Is The Least Affordable Since 1988

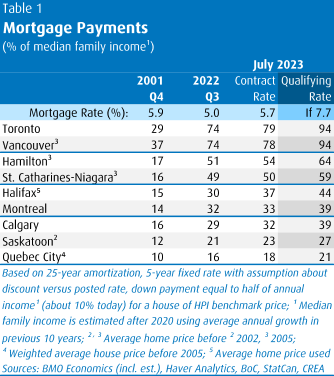

Nearly two generations of Canadians haven’t experienced such unaffordable shelter. In Greater Toronto, payments would cost buyers four-fifths (79%) a median household’s income. Keep in mind, this isn’t a ritzy part of town or even the downtown core. This is for a typical home across the whole Greater economic region, including its burbs.

“That’s just for the mortgage [in Toronto]; you could easily spend another 8% of income on property taxes, heating, condo fees, and other housing costs,” says Sal Guatieri, the BMO economist that authored the analysis.

It doesn’t get much better for most of Canada’s households. In Vancouver, a median household also needs to spend 78% of their income for a home. But these are big cities, right? The rest of the country must be significantly cheaper.

Zooming out is cheaper, but still out of reach. The national average is 39% for a mortgage, the maximum a borrower can lend. It screams credit-driven issue, but that’s beside the point. Once again, this is just the mortgage. Additional costs regularly incurred for homeownership drive that cost even higher.

Policymakers might boast of cost of living improvements, but housing is getting worse. “The [below] table shows that affordability has worsened in the past year due to higher interest rates and a partial rebound in prices,” says Guatieri.

Source: BMO Economics.

The Stress Test Is Stressful

Stress testing further complicates the issue. The stress test qualifies borrowers at a higher rate to ensure they can make the payments. It already proved its value during the recent rate hikes, reducing over leveraging. However, already high income requirements combine to make cities like Toronto less attainable.

“Qualifying at a rate two percentage points above your contract rate would imply mortgage service costs of 94% of annual income. That’s well above the bar set for federally regulated lenders of 39% which also includes other housing expenses,” Guatieri explains.

Canadian Interest Rates Were The Same In 2001, But Home Price Growth Tripled Income

Canadian interest rates are the highest since 2001, but affordability is much worse. The bank’s table shows that buying a home in 2001 required a “modest” 29% of income. Today is very different, largely due to Canada’s focus on non-productive growth.

“The difference is that prices have run nearly three times faster than incomes since then, spiking the ratio from four times income to eleven,” says Guatieri.

Not All of Canada Is Unaffordable, Just The Places You Want To Live

Despite surging home price across the country, some markets are still in reach. Most of Canada’s major cities are really close together, resulting in contagion. However, Canada’s a big country, and some markets just haven’t responded the same way.

“The problem is that a quarter of residents live in the two regions that are well beyond the reach of most buyers, while many other regions have become terribly expensive in the past three years,” he explains.

Adding, “If you want both affordability and life in the big city, then head to Montreal, Calgary or Ottawa, where mortgage payments consume just one-third of income, and many buyers would still pass the stress test.”

Calgary continues to print new highs, despite a recent pullback in other markets. The bank also suggests Saskatoon, Regina, Winnipeg, Edmonton, Quebec City, and St. John’s. All of those regions have servicing costs around 20% of the median income. They further note that some of those market may appeal to investors, due to the low input costs. Low input costs make it much easier to run a profitable rental.

Would Falling Interest Rates Help Affordability? BMO Believes It Can

Don’t expect relief anytime soon, since the bank’s take would be virtually impossible. “Relief will come only if interest rates fall sharply and prices lag incomes for a lengthy period,” explains Guatieri.

It’s a reasonable-sounding take, especially considering the rate home prices outpaced incomes. There’s just one kink in that take—lower rates have never improved affordability. Bank of Canada (BoC) research shows falling rates failed to improve affordability. Over the past 20 years, they helped to boost prices. Home prices adjusted to consume the additional leverage provided.

The Dutch central bank also found low rates funnel assets to richer households. A greater share of assets concentrated in wealthy households post-low rate shock. The wealthier the household, the more leverage provided by low rates. The math is also easier on investment properties when input costs are lower. Ultimately, this stimulates more demand.

The issue should be obvious at this point. We literally just saw a low rate shock result in a surge of investors and eroding affordability. But apparently no one can remember what happened immediately before rates surged.

Good article. The offshore money laundering that went on specifically in Toronto and Vancouver housing market was well written, there was no ceiling and frequently homes were bought with cash, outbidding buyers driving prices higher. The Fed Gov recently put in place and inability to buy a home in Canada if you don’t live here. There is a loophole of course,any exchange students coming from the same regions instead of looking for a place to live , they come with money and buy homes outright to live in while attending school. When they are finished school, they return to their homeland leaving the home empty , the owners waiting for increase in property values to sell. The empty house tax has caused some to sell . Double edged sword.

“The issue should be obvious at this point. We literally just saw a low rate shock result in a surge of investors and eroding affordability. But apparently no one can remember what happened immediately before rates surged.”

************

House prices will fall in response….historically, that has always been the case.

We all thought the hikes would make the dream of Canadian home ownership a reality …

It remains a dream.