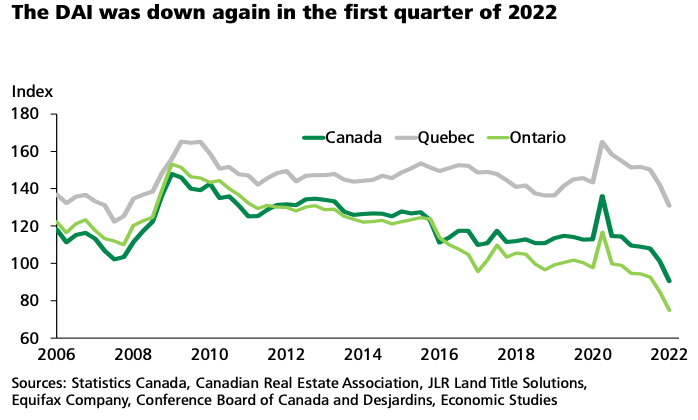

Canadian real estate prices may be slowing now, but the damage got even worse in the year’s first quarter. The Desjardins Affordability Index (DAI) reached the worst level recorded in Q1 2022. Home prices continue to become more overvalued, even as incomes fall.

The Desjardins Affordability Index (DAI)

The DAI is an inverse affordability index designed to assess the risk of a housing correction. If the Index falls below the long-term average, housing is generally overvalued. Overvalued housing is vulnerable to corrections or stagnation. The latter is only a real possibility if it’s not too overvalued or a whole generation is willing to live with insecure shelter for a very long time.

“The housing market can therefore no longer be considered affordable and is unlikely to sustain drastic new price increases,” reads the methodology for the tool.

Canadian Housing Affordability Has Never Been Worse In The DAI

Housing affordability is rapidly eroding and the worst in the DAI’s history. The Index dropped 10.7 points in Q1 2022, hitting the worst affordability ever. Unfortunately the Index only goes back to 2006, but other indexes show how bad things actually are. Affordability hasn’t been this bad in three decades and is likely to get worse.

The long-term average of the Index highlights how overvalued home prices are. Since 2006, the affordability Index has an average value of 121.1. This means affordability is 25.3% worse than average, implying significant overvaluation.

Canadian Real Estate Prices Are Rising While Incomes Fall

Rising home prices, rising mortgage costs, and falling incomes are converging. The average sale price of a home increased 9.2% in Q1 2022 to $782,204 across Canada. Meanwhile, the average after-tax household income fell 0.3 points to $95,061 during the same quarter. To say it’s an unusual dynamic for home prices to rise while incomes fall is an understatement.

Buying A Home In Canada Requires $42,000 Per Year In Payments

The cost of ownership (mortgage, property tax, and utilities) climbed sharply last quarter. Payments for an average home rose 11.6% in Q1 2022, hitting $42,220 per year. Remember, that’s an average home across Canada, not Toronto or Vancouver. High-flying cities like those are even more expensive with similar income levels.

Canadian Home Prices Expected To Slow, But Affordability To Lag

The methodology might clearly explain what this means, but the take was a little more tepid. “We expect average sale prices to moderate over the next few quarters,” explains Desjardins’ senior economist.

Though they add, “But affordability will remain under pressure as mortgage rates go up in response to the Bank of Canada’s recent quantitative tightening and policy interest rates have begun to rise.”

Declining affordability is usually temporary as values adjust to the cost of capital. Historically higher interest rates result in lower home prices, as budgets shrink. Higher rates also tends to send capital to more productive areas, such as businesses. Low interest rates have also historically inflated home prices and failed to improve affordability.

Greater Toronto home prices have already slipped after two months of higher rates. It’s too early for the rate hikes to have done the damage, so this likely has to do with a change in mindset. Speculators are out looking for other areas to allocate.

@betterdwelling Greater Toronto real estate prices just made the 2nd biggest monthly drop in the history of the composite benchmark. #toronto #torontorealestate

♬ Drop,drop it-剪辑版-剪辑版 – Official Sound Studio

Desjardins’ Affordability Index implies significant overvaluation, but it’s not alone these days. Reading 25% below the long-term average is a number that resonates with other models as well. A price correction around that size is forecast in models from Moody’s and Oxford Economics.

Good article what is missing in the political mantra regarding affordable housing are the concerns raised by Canadian actuarial studies and guidance for special reserves apparently they have never been accurate and now with inflation are a disaster just waiting for happen for many condo owners.

My mortgage is less, but I’ve accounted for a few rate hikes thankfully